Mediocre performance for Hungarian industry

Hungarian industry did OK in the second quarter with a small monthly increase in production volume in June. We are less optimistic about the future than some high-frequency data suggest

| 4.8% |

Industrial production (YoY, wda)ING forecast 4.2% / Previous 3.4% |

| Better than expected | |

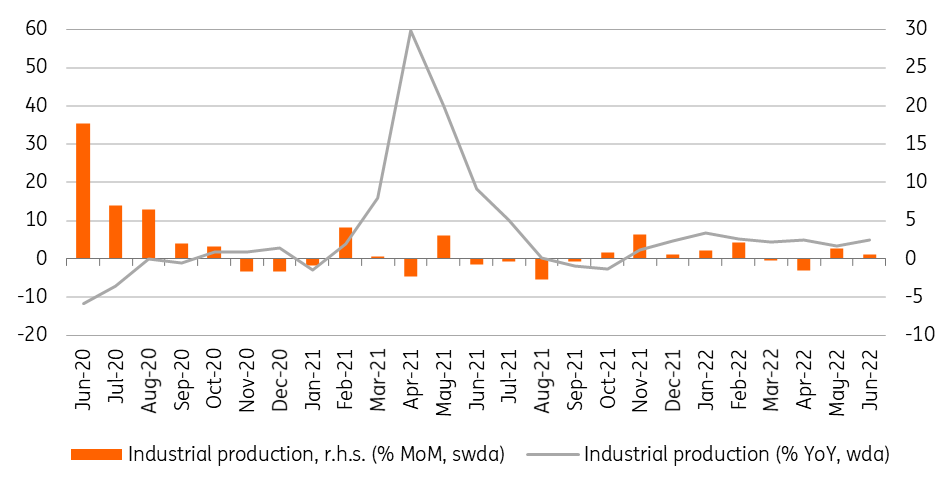

We saw big differences between raw and calendar-adjusted data in May, and the same was true in June. According to the raw data, industrial production rose by only 1.5% on a yearly basis, while the rate of growth came in at 4.8% after adjusting for calendar effects. The significant difference is due to the fact that there was one less working day this June than in 2021. So in a nutshell, industrial production in June was OK, though the 0.6% month-on-month growth won't amaze anybody.

Performance of Hungarian industry

When it comes to the second quarter as a whole, after the production drop in April – when war and sanctions hit global value chains – producers were able to fix the majority of their supply issues by the end of the quarter. By June, the volume of production matched the level seen pre-war. This means there was only slight growth on a quarterly basis in industry. Alongside the stagnant performance of retail sales in June, there are clear signs of a significant weakening of economic activity in the second quarter. The soft landing has already started.

Production level and quarterly performance of industry

We have to wait another week for the details behind industry’s performance, so we can’t see exactly which subsectors contributed to the expansion of industry and to what extent. However, the Central Statistical Office (CSO) highlighted in its short commentary that vehicle manufacturing and the electronics industry expanded on an annual basis. This supports our view that manufacturers were able to solve (at least partially) their supply chain issues.

Last month, we raised the question about the durability of the food industry in the wake of the drought and supply side problems. It seems – at least in June – that the sector managed to resist the negative effects of the drought and supply issues, as the statistical office underscored the sector’s strong growth. Unfortunately, apart from the three sectors just mentioned, production decreased across the others – almost without exception – based on the CSO's commentary.

Factors limiting production

Some might point out that the stock of orders was up by 30% year-on-year in May (June data will be released later) and the manufacturing PMI remained deep in expansionary territory in July. But Eurostat data shows that capacity utilisation has been on a downward trend since the end of 2021, and it dropped below the historical average by the third quarter of this year. The longer delivery times suggested by the PMI readings explain part of the high level of orders, while high demand means nothing if there isn't enough supply.

Speaking of which, the latest developments around Taiwan are worrisome and we can only hope that history doesn't repeat itself. With the live military drill, global trade will face short-term constraints, and if it collapses entirely it would make it impossible to supply manufacturing sectors with semi-conductors and related spare parts.

Manufacturing PMI and industrial production trends

As we mentioned above, the July manufacturing PMI of 57.8 looks promising. But two factors are keeping the reading high. The price sub-index is standing at 95.4, suggesting harshly rising input prices and a willingness to pass on costs to consumers. On the other hand, the orders sub-index is 74.7, so strong demand is fueling optimism. As we mentioned, however, this doesn't ensure that production will continue uninterrupted. In all, we are less optimistic about the future of industry than some high-frequency data suggest.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap