Malaysia’s April manufacturing signals GDP acceleration in second quarter

Firmer activity and low base effects support our view that GDP growth will accelerate and that the BNM will remain on hold for the rest of the year

| 4.0% |

April industrial production growth |

| Higher than expected | |

Upside April manufacturing surprise...

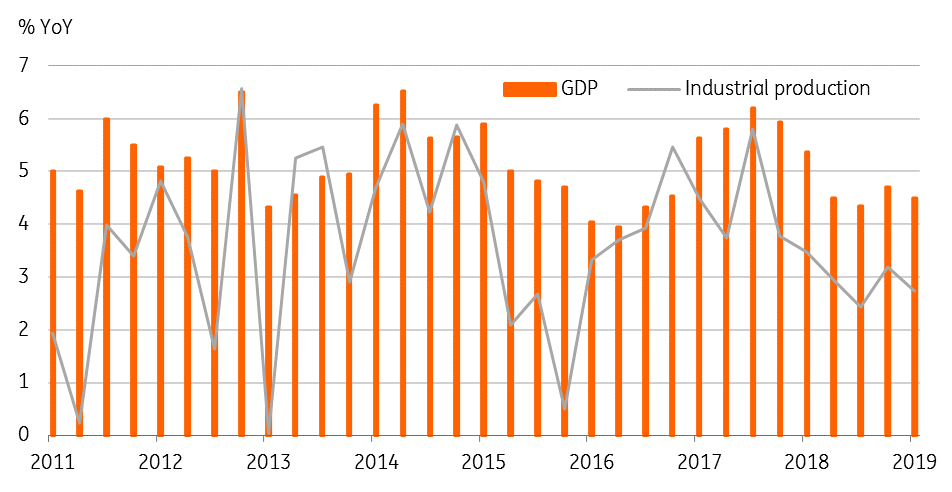

Malaysia’s manufacturing followed on from exports with an upside growth surprise in April.

The 4.0% year-on-year industrial production growth in April was an acceleration from 3.1% in March. This contrasts with the consensus view of a slowdown to 2.5% (ING forecast 2.4%). But the data is in line the earlier release of April exports, which showed a return to positive growth territory after two consecutive months of decline (+1.1% vs. -0.5% in March).

As well as industrial production, manufacturing sales growth also picked up in April to 6.8% from 5.7% in the previous month. On the flip side, manufacturing jobs growth slowed for the second consecutive month (1.7% vs. 1.8% in March), and wage and salary growth moderated to over a two-year low (4.4% vs. 5.1% in March).

… heralds firmer 2Q19 GDP growth

Manufacturing drives GDP growth and the April data provides an initial gauge of GDP growth in the second quarter of the year.

GDP grew by 4.5% YoY in 1Q19, which we believe was the low in the current cycle. The surprisingly strong activity growth signals a pick-up in GDP growth in the current quarter. Moreover, favourable base effects are also at work, and should assist in driving GDP growth higher over the remainder of the year. We will look for more evidence of activity strength persisting in the months ahead before adjusting our 4.6% annual growth forecast for 2019. Given the intensified global trade risks, any upward adjustment is risky.

However, we believe the BNM will take comfort in the latest data, which will enable them to leave policy on hold for the rest of the year after their 25bp rate cut in May.

Manufacturing drives GDP growth

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap

11 June 2019

Good MornING Asia - 12 June 2019 This bundle contains 3 Articles