Malaysia: Manufacturing points to slower GDP growth

Apart from slowing exports and manufacturing, a tighter fiscal policy stance will be a potential headwind to GDP growth. We maintain our view that the central bank will leave monetary policy on hold through 2019

| 2.2% |

August industrial production growth |

| Lower than expected | |

Exports drag manufacturing lower

Following on from surprisingly weak exports in August, industrial production growth slowed to 2.2% year-on-year in that month from 2.6% in July. The outcome was slightly weaker than the consensus, which centred on 2.3% growth, with estimates ranging from our low-end 1.6% to 4.5% YoY. Manufacturing and utilities dragged headline IP growth lower, while mining continued to contract albeit at a more moderate rate than in July.

Among other manufacturing indicators including sales, employment in the sector and wages, all posted slowdowns in August. Manufacturing sales growth of 8.1% YoY was down from 9.6% in July. Wage growth eased to 9.7% from 10.1%, and jobs growth to 1.9% from 2.0%.

GDP growth is poised to slow further

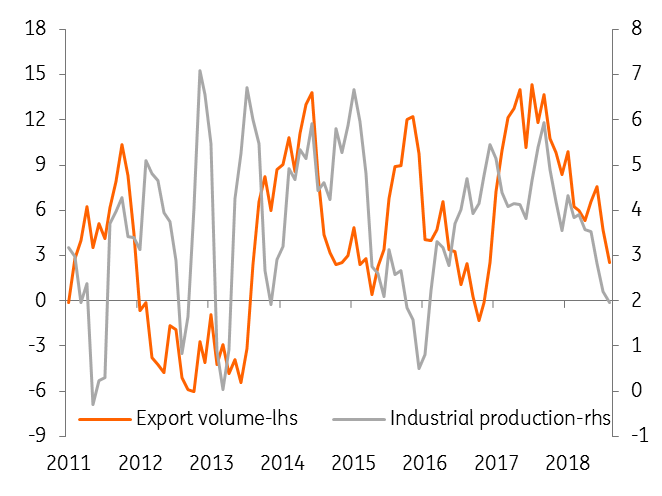

Both exports and production growth are slowing on a trend basis (see figure), which will be associated with a slowdown in GDP growth. The high base-year effect also has been in play in driving the GDP slowdown. We expect GDP growth to settle around 4% in the second half of the year, for a full-year average growth of 4.5%. Our forecast for 3Q remains at 4.1%.

Downtrend in exports and manufacturing

Fiscal headwinds to growth

With the economy enjoying the lowest rate of inflation in Asia the central bank (Bank Negara Malaysia) has greater policy leeway to support growth in the period ahead. Earlier this week, BNM Governor Nor Shamsiah Yunus expressed confidence about robust private sector activity continuing to support the economy into 2019 even as global trade tensions weigh on exports.

However, we believe the tighter fiscal policy stance will be a potential headwind to growth. The government is considering new taxes and asset sales to make up for the revenue loss from scrapping the Goods and Services Tax and to repay its debt. We maintain our view that BNM will leave the rate policy on hold through 2019.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap

11 October 2018

Good MornING Asia - 12 October 2018 This bundle contains 5 Articles