Malaysia: Electronics and oil support strong trade growth

An undervalued currency helps favourable terms of trade, leading us to expect strong GDP growth and Ringgit appreciation in 2018

Optimistic trade growth expectations

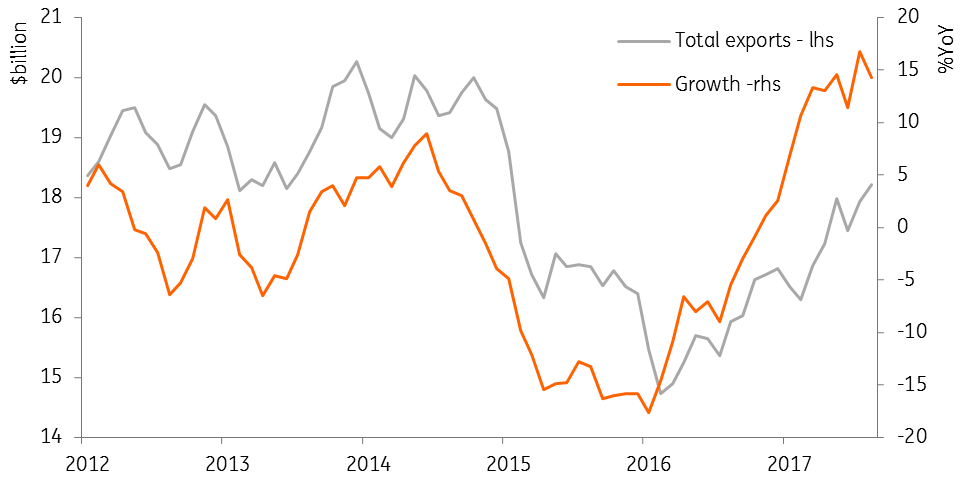

The best of the trade growth this year may be behind, but strong global electronics demand and firmer oil prices continue to support trade growth of around 20 percent (MYR-denominated). The consensus centres on 20% growth in both exports and imports in September (data due Friday 3 November). We are a bit more optimistic on exports growth expected around 24% YoY but in line with consensus on import growth.

The electrical and electronic products category accounts for 36% of total exports, and half of these are semiconductors. We take our cue from the 70% year-on-year surge in Korea’s semiconductor exports in September (and that pace was maintained in October), although it was less dramatic in Taiwan (20%) and dismal in Singapore (-3.7% domestic and +4.3% total).

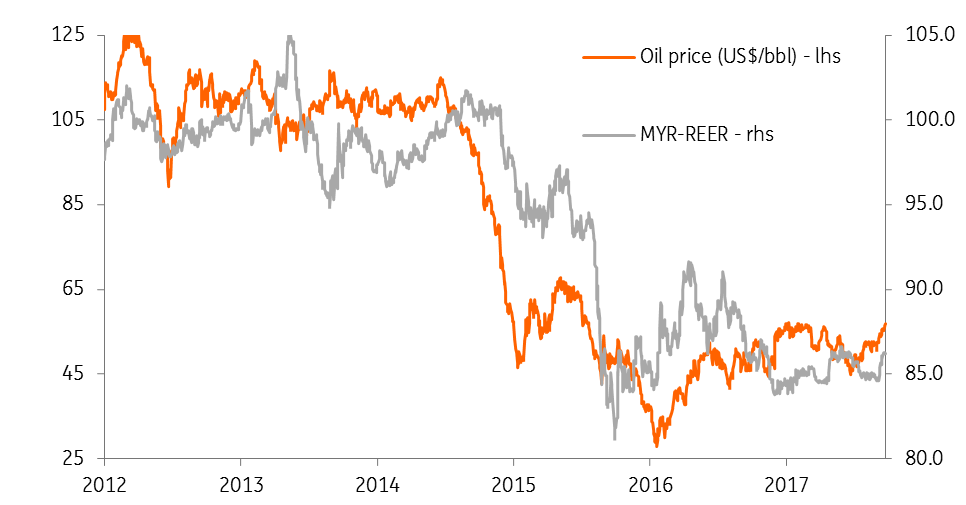

Oil-based commodities are the other dominant exports from Malaysia tracking global oil prices higher. The average crude price was up 7.0% month-on-month and 17.5% YoY in September.

Oil-driven exports surge may have peaked

Above-consensus growth expectation

Strong trade growth and accommodative macro policies support our above–consensus forecasts of 5.7% GDP growth in 3Q17 and 5.6% growth in the full-year 2017 with the consensus being 5.0% and 5.2%, respectively. While the economy will continue to derive its strength from domestic spending, the wider trade surplus suggests net trade will also continue to contribute positively to the GDP growth.

The USD 14bn year-to-date trade surplus through August was USD 1.1bn wider than a year ago. We forecast a widening in the current account surplus to 2.6% of GDP in 2017 from 2.1% in 2016 while consensus is 2.2%.

| 5.6% |

ING 2017 growth forecast |

Undervalued MYR is still positive for exports

Undervalued Ringgit sustains favourable terms of trade

An undervalued currency helps favourable terms of trade. We do not see a sufficient policy initiative yet to help the Malaysian Ringgit (MYR) recover the 15% undervaluation left by the commodity price crash.

That would need higher interest rates. But while the political environment is likely to prevent Bank Negara Malaysia (BNM) from raising interest rates anytime soon, we don't rule out an earlier rate hike than our 3Q18 first hike forecast.

We expect the MYR to remain among the top performing Asian currencies in 2018. Our USD/MYR forecasts are 4.19 for end-2017 and 4.00 for end-2018 (spot 4.23, cons: 4.21 and 4.00, respectively).

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap