Russia: Lower FX purchases in April - small consolation to RUB

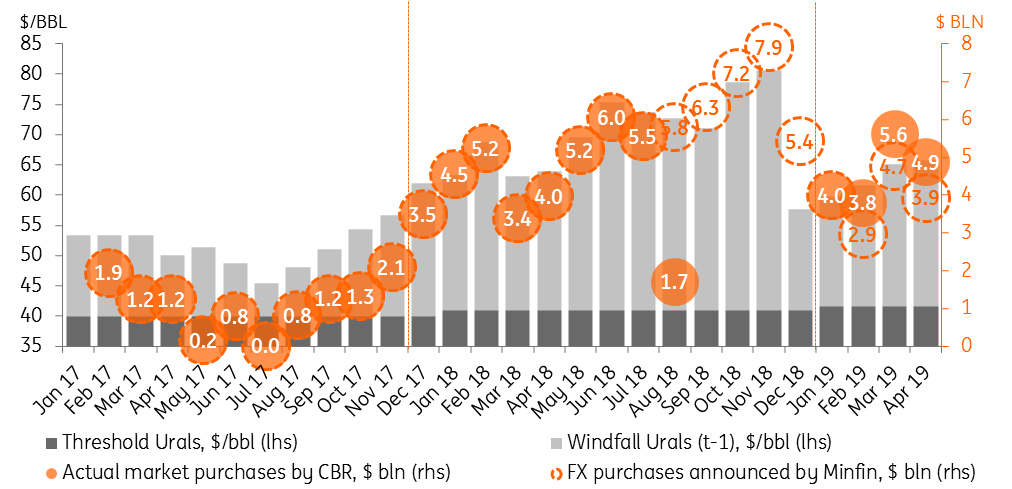

April FX purchases of c.$4.9bn, including a $1.0bn backlog from 2H18, are $0.9bn lower than consensus and $0.7bn lower than March's $5.6bn. While short-term positive, this does not change our cautious mid-term view given the expected halving of current account surplus to c.$4-6bn per month in 2-3Q19.

| RUB255bn |

Minfin's FX purchases for Aprildown from RUB310bn in March |

| Lower than expected | |

The Russian Finance Ministry announced that it will spend RUB255bn ($3.9bn equivalent at the current FX rate) for FX purchases between 5 April and 13 May, in accordance with the budget rule. The sum comprises the RUB307bn in extra fuel revenues of the budget expected in April (close to our forecast of RUB320bn) and the RUB55bn downward revsion in the extra fuel revenues for March. Combined with the catching up on the August-December 2018 backlog, when the Bank of Russia put market purchases on hold, the total amount of FX purchased on the market will total $4.9bn in April, down from the $5.6bn seen in March.

Monthly FX purchases by Russian Finance Ministry/Central Bank

As the amount of FX to be purchased is slightly below expectations, the news might be taken positively by the market in the short term. Additional support to FX may come from the sale of Sberbank's Turkish asset estimated at $3bn and expected to take place in 2Q19. According to the bank's management, the actual proceeds may be higher. It is also unlikely that there will be any corporate foreign debt redemptions in 2Q19, given the seasonality.

However, for the mid-term we maintain our cautious view on RUB performance in 2Q-3Q19, as the expected shrinking of the current account surplus from c.$10bn per month in 1Q19 (balance of payments data to be released on 9 April) to $4-6bn per month in the upcoming 6 months - amid expected $5-6bn FX purchases - leaves the local FX market vulnerable to portfolio flows, which are subject to volatility. The Russian state bond market (OFZ) managed to attract $2bn of foreign portfio inflows in 2M18 and may have added another $2bn in March, helping RUB to appreciate 6% vs USD in 1Q19, outperforming EM peers. However, with a new round of global growth concerns and persisting foreign policy risks for Russia, repeating this result in the coming months looks challenging.

We see USDRUB returning to the 66-67 range in 2-3Q19 as a plausible scenario.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap