LME Aluminium Stocks: ‘Go West’

Tensions are high ahead of the US Section 232 decision on aluminium trade tariffs. High US premiums are now pulling across borders as traders rush to deliver material ahead of possible duties and Asian stocks won't hang around long; it's 2017 all over again

Asian stocks won't hang around for long

LME aluminium stocks are set to remain volatile as tight backwardations and high premiums are pulling in opposing directions for inventory.

A net of 66kt of LME aluminium warranted inventory has been cancelled in the last two days. (i.e earmarked for delivery). The cancellations are predominantly in Malaysia and go some way to erode the mass of deliveries/re-warranting that boosted live Asian stocks by 370kt in the first three weeks of February.

Tight spreads had originally incentivised the deliveries. Backwardations make it costly to finance stock because rolling the short hedge incurs a cost. An extreme Feb-March roll of $50bn has since rolled over but the Cash-March remains at $28bn and squeezing any remaining short. If warehouses also offer incentives, then delivering on to the exchange is a tempting exit for stock holders.

On the other hand, selling in the spot market earns the physical ex-LME premium and the US becomes the obvious destination for the material. Premiums there have rallied 45% year-to-date to 13¢/lb and the CME curve is pricing up to 16¢/lb for 2019. A portion of the higher premiums reflects rising inland freight costs which must be borne by the deliverer looking to exploit the gap. However, weekly tradestop data suggests these freight costs actually peaked in December so most of the further gains in the premium are pure arbitrage.

We expect more Asian material to head west for the higher premiums in coming months. It's 1Q 2017 all over again.

Deja vu: LME aluminium stocks on warrant in Asia (mt)

Asian premiums on the rise

As we expect more stock to flow east to west the resulting tighter availability in Asia should see premiums there on the rise. Japanese smelters are currently entering negotiations for the 2Q MJP benchmark that sets rates for most tonnage into Japan and surrounding Asia. Opening offers have come in 31% above 1Q reflecting the knock on expectations from the US premiums.

Spot assessments have also jumped $6/mt last week to $105/mt according to Harbor. Whilst spot is likely to stay well below the benchmark, narrowing the wide gap to the US is a trend we expect at least before any trade duties are imposed.

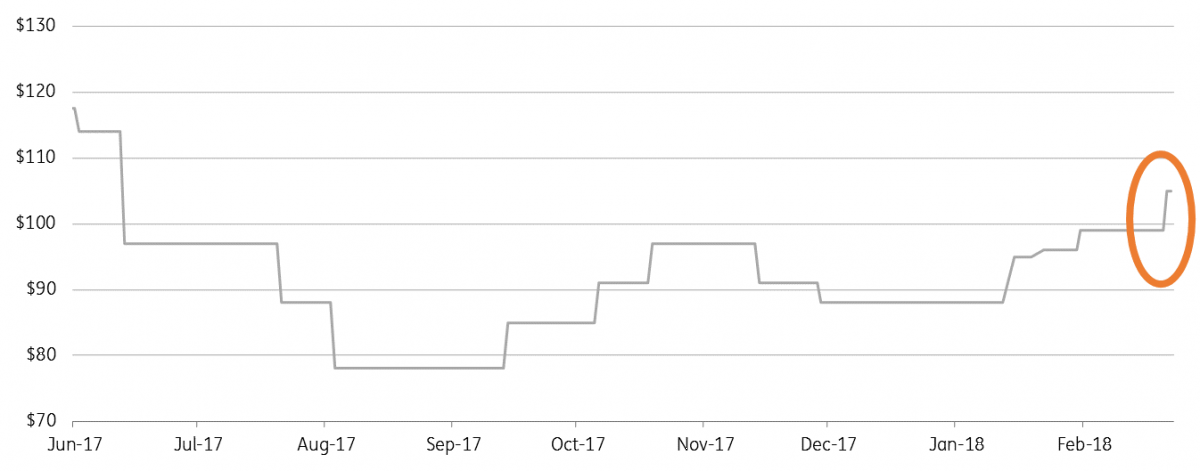

About time...MJP premiums following US higher

Knock on to the LME

As outlined in our 2018 Aluminium Outlook, tightness in the LME curve has been a key driver for higher aluminium prices via short covering. Only by higher free-floating on warrant stock levels will tightness in the LME curve be alleviated. The US premium pull ahead of trade tariffs is however set to bring more stocks through the customs barrier and beyond the domain of LME warehouses in the free trade zones. We expect any customs cleared US stocks to be effectively isolated from the exchange unless backwardations reach extremes. A flow of material into Asian warehouses amid lower Asian premiums and tight spreads had seemed all that could hinder the tightness building which is why we find the latest moves in both stocks and premiums extremely significant.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap