Latest Hungarian activity data shows a glass half full

… or half empty, depending on who you are asking. Industry caused a significant upside surprise, while retail sales disappointed in November. We downgrade our 2021 outlook

The Hungarian Central Statistical Office released the latest set of data about industry and retail sales. The picture is mixed but not in the way we used to see. In November, retail sales provided the downside surprise, while industrial production surprised to the upside. So what we gained on the swings we lost on the roundabouts.

Industry

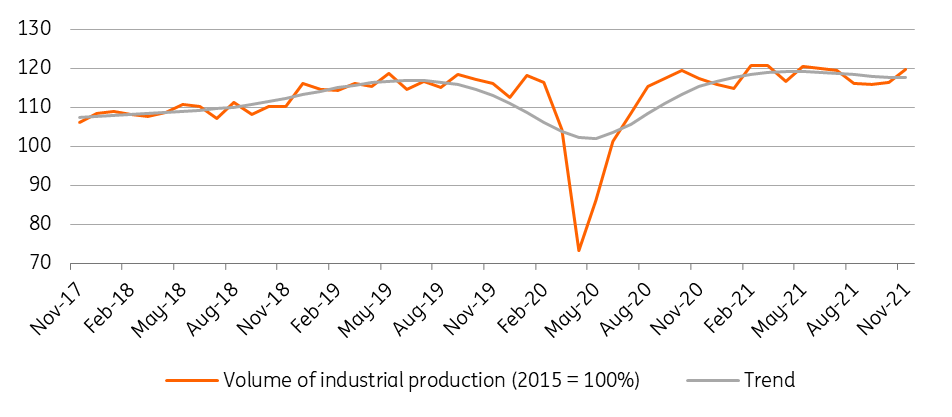

The performance of industry came in way ahead of expectations in November 2021. On a monthly basis, industrial production improved by 2.9%, the strongest monthly performance since May. In parallel, the year-on-year performance improved a lot, showing a 2.6% gain in volume terms compared to last November. This also means that the dip we saw during the summer months was entirely wiped out over just one month and the level of production is back to the highs seen in spring last year.

Volume of industrial production

The most spectacular part of the November surprise is that the smaller sub-sectors were able to counterbalance the weakness in car and electronics manufacturing. Carmakers are still facing input constraints and one-shift production (instead of the regular three shifts), thus car making dropped significantly. Semiconductor shortages are also affecting electronics producers, so this subsector’s performance was also weak. But the Statistical Office revealed that strong growth was measured in all the other manufacturing sub-sectors. So smaller sectors (together) were able to finally punch above their weight.

Performance of Hungarian industry

We don’t know whether this is just an outlier or the start of a longer positive trend, but this at least gives some hope. Hope which is much needed given that we can’t expect a sudden revival of car- and electronics manufacturing in Hungary, as we see supply chain shocks being a drag on growth in industry and exports at least over the first half of 2022.

Retail sales

In contrast to industry, retail sales surprised to the downside in November. The volume of turnover was up by 3.8% YoY, which doesn’t look bad at a first sight. However, on a monthly basis retail sales volume dropped by almost 0.2%. This is the first time in seven months that the sector has shown a decrease, putting an end to a series of good performances.

Breakdown of retail sales (% YoY, wda)

The reasons for the negative surprise are two-fold. First, there is fuel retailing, where sales volumes decreased by 2.4% MoM. Yes, fuel prices skyrocketed during early November, but this was also true in October and yet it didn’t have such an impact. Moreover, the government decided to set maximum fuel retail prices at a much lower level than the peak from mid-November. What could have complemented the negative sales effect of the early November fuel price spike is the spread of Covid, which might increase cautiousness and decrease mobility again.

Besides fuel retailing, we can identify a second cause. Non-food retailing put in a weak performance (+0.3% MoM), especially compared to our forecasts based on the expected Black Friday sales. As it turned out, buyers weren’t as keen to spend money as we thought, as the sales event was more moderate. In other words, inflation spoiled the buying frenzy. Sales volumes fell by 7.4% YoY in furniture and electrical goods stores, showing the impact of a high base from the previous year and low turnover from the Black Friday event in 2021.

As for food retailing, monthly growth is broadly in line with the average of the past six months. In all, the combination of more moderate Black Friday promotions, soaring fuel prices in early November and the resumption of Covid in the second half of November resulted in a weaker-than-expected retail performance.

Retail sales volume in detail (2015 = 100%)

2021 GDP outlook downgraded

After a mostly disappointing October and a mixed November, we see only 0.5% QoQ GDP growth in the fourth quarter. This means that we downgrade our 2021 outlook from 7.0% to 6.7%.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap