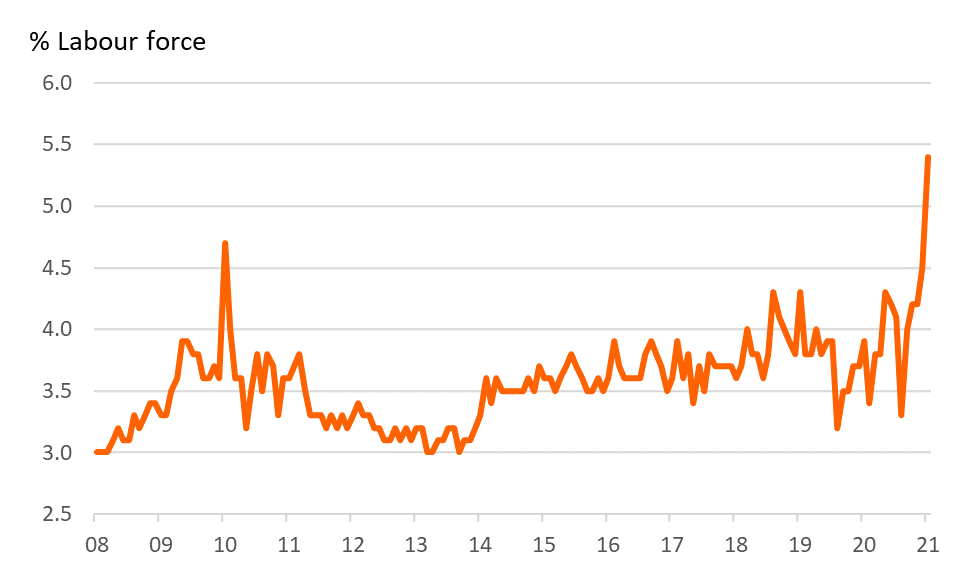

Korea’s Jan unemployment rate highest since 1999

At 5.4%, the unemployment rate in Korea has risen from 4.5% in December, to its highest rate since 1999, suggesting the government's support measures may need a further boost

| 5.4% |

Unemployment rateHighest since 1999 |

| Higher than expected | |

If you thought last month was bad

Last month, we tried and failed to come up with any silver linings to the rise in the December Korean unemployment rate to 4.5% from 4.1% (now revised to 4.2%). There were none that we could find. This month, the increase in the January unemployment rate has extended even further to 5.4%.

Korea has not seen unemployment rates this high since 1999, in the aftermath of the Asia crisis that started in Thailand in July 1997.

Once again, the breakdown of the news is not encouraging.

Unemployment rate in Korea surges

It still looks bad

Like last month, the economically active population (the denominator in the unemployment rate calculation) has fallen by a hefty 273 thousand. Employment was down a whopping 708 thousand, with the biggest falls in construction (-114,000), wholesales/retail/hotels (-90,000), and in business/personal services (-436,000). Manufacturing jobs rose by 35 thousand, showing a clear split still between the manufacturing and service sectors.

Echoing these employment figures, the numbers of unemployed rose 435 thousand to 1.57 million.

Government spending should be helping

The government measures to support the economy build on a front-loading of the KRW558tr annual fiscal deficit in 1H 2021 following the Finance Ministry's decision to downgrade their forecast for GDP growth in 2021 to 3.2% from 3.6%. At 2.6%, our GDP forecast for 2021 is already below the consensus, and we can probably ride the existing number for a while as we see how other data pan out. The government's support measures for 2021 include cheap export loans to exporters, public investment spending, and tax credits for credit card spending above certain limits.

But these latest unemployment figures may indicate that not enough is coming through, or at least, not quickly enough, potentially requiring a tweak to the timing of existing planned measures, or an outright expansion. With the labour market a lagging indicator of the economy, and exports looking reasonable in recent months, there is still some merit in waiting to see what further data bring, but the rapidity of the unemployment increase suggests that any pause for reflection could be a short one.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap