Korea: GDP grows by more than expected in 2Q22

Korea’s solid growth in 2Q was mainly led by a recovery in consumption thanks to the reopening boost. However, the growth outlook for the second half will not be as strong

| 0.7% |

2QGDP%QoQ, sa |

| Higher than expected | |

Consumption was strong enough to offset the weakness in external demand

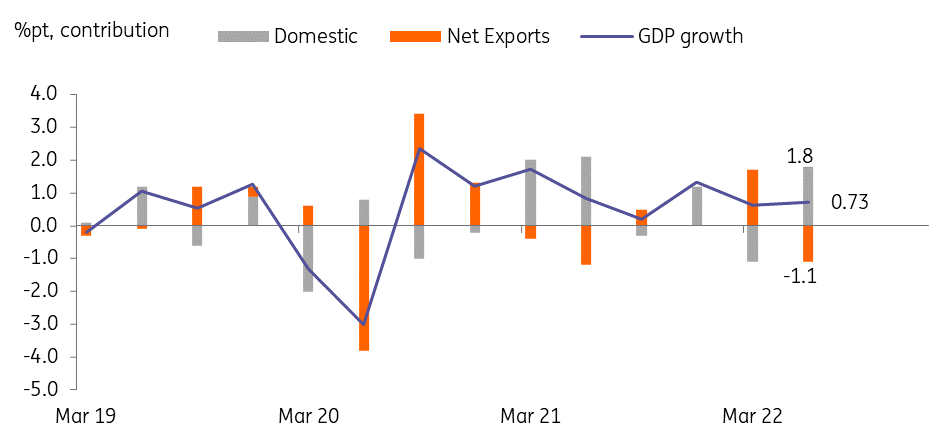

Korea’s 2QGDP rose 0.7% QoQ sa (vs 0.6% in 1Q), beating the market consensus of 0.4%. The contributions to GDP showed a drag from net exports while the recovery in private consumption led overall growth.

Exports and imports fell by -3.1% and -0.8% respectively, reflecting weak external demand for chemicals and basic metals. As China is the main destination for basic metals and chemicals, the strict lockdown measures in 2Q appeared to have had a negative impact on Korea’s exports. The decline in oil imports also suggested weak external demand as most of the imported oil is re-exported through refining.

Domestic demand grew solidly mainly due to a strong recovery in consumption while investments remained relatively soft. Private consumption was up by 3.0% (vs -0.5% in 1Q22) with semi-durable goods consumption and services increasing. Among services, transportation and culture/recreation-related services grew the most by 9.8% and 9.0% respectively. The damage caused by the truckers' strike appeared to be overshadowed by a strong increase in travel-related transport services. However, the investment components stayed weak. Construction posted a limited rebound of 0.6% (vs -3.9% in 1Q22) and facility investment contracted for the fourth consecutive quarter.

Domestic demand driven growth in 2Q22

Growth is expected to slow in 2H

We expect consumption-driven growth to slow this quarter. The initial pent-up demand-driven spending will normalize soon as high inflation weakens consumers’ purchasing power. Survey data suggests that consumer sentiment has been hit faster and harder than expected by the BoK’s recent rate hikes. The debt repayment burden will increase as more than 70% of outstanding loans are based on floating rates. Also, the recent resurgence of covid cases will rein in consumer spending and activity to some extent. External demand conditions will also adversely affect the Korean economy as demand from the US and EU is expected to slow sharply. Despite all these downside risks, we do not expect a contraction in the second half of this year. Accommodative fiscal policy will continue to buffer the economic downturn, and in order to reduce households' debt burden and reduce systemic risks, the government is proposing a number of new measures such as the establishment of bad banks and refinancing of fixed-rate loans.

The Bank of Korea’s hawkishness may strengthen

Today’s stronger-than-expected growth should provide some relief for the BoK, which can focus on containing inflation for the time being and further strengthen its hawkish stance if necessary. Although the possibility of a 25bp hike in November is rising, if inflation stabilizes in 4Q as we expect, then we think that the BoK will take a pause after delivering two 25bp hikes in August and October.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap