Korea: Production bounces in August

South Korean industrial production grew 1.4%MoM in August, lifting the annual rate of growth from 1.0% to 2.5%YoY. With inflation soft, this isn't enough to spur the Bank of Korea to respond any time soon

Korean production data - better than feared

Recent Korean data has not been very uplifting, so today's August production release showing growth of 1.4%MoM, 2.5%YoY, makes a welcome change. We think Korea has been undergoing an old-fashioned inventory-led slowdown, the sort that used to be "fashionable" before the global financial crisis hit and unorthodox monetary and fiscal policies sought to boost asset prices and squeeze growth higher by any means possible. Korea didn't engage in any of that, but like everywhere else, was swept along on a tide of production that wasn't quite matched with genuine demand.

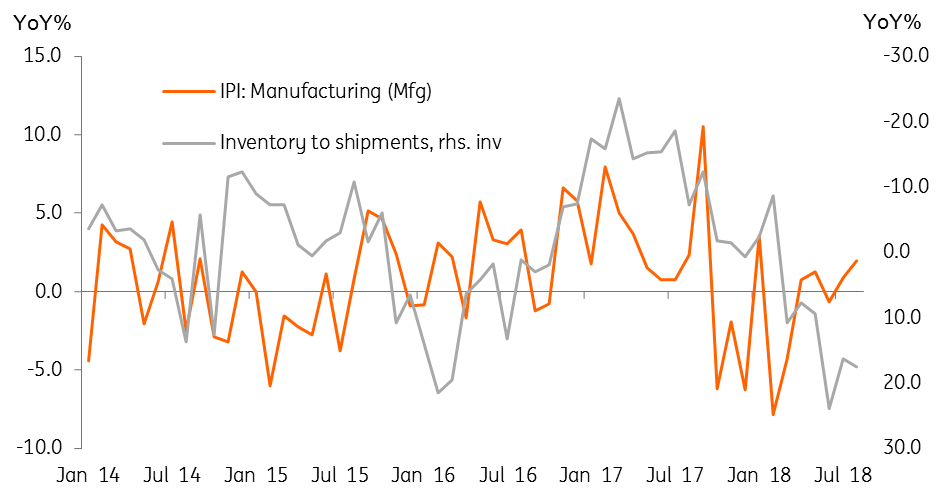

Production and inventory to shipments ratio (inverted)

Inventory ratios still weighing on production

Rising inventory ratios (shown inverted so falling in the above chart) look as if they may be bottoming out, although manufacturing output seems to be leaping ahead of any genuine improvement here, and we may see a further pullback in the months ahead.

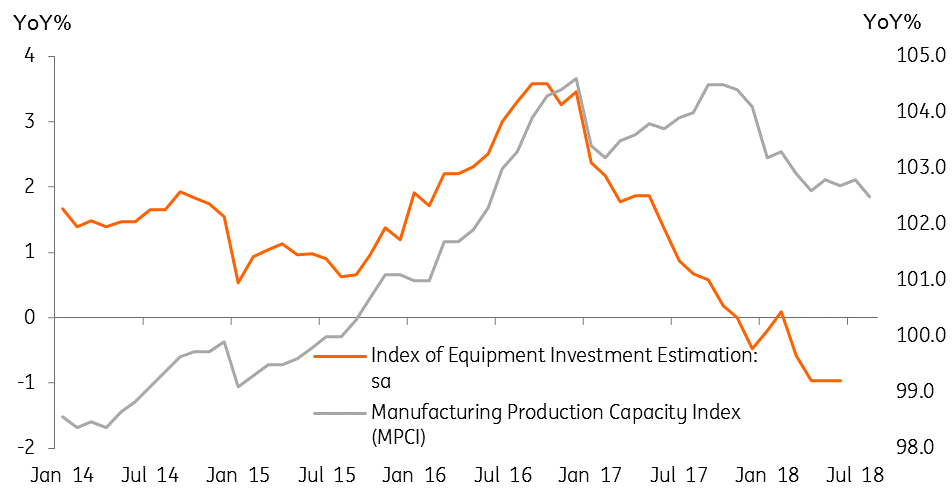

But manufacturing operating ratios are improving, thanks mainly to continued weakness in equipment investment, and this is helping to lift profitability, and in turn, output.

While the investment story does not sound an encouraging one, it too should turn in due course, and may already be starting to do so, which will provide a broader boost to what is currently fairly soggy and consumption-driven economic growth.

Korea investment and production capacity

BoK on hold for rest of the year

Overall, this is a satisfactory, rather than good set of figures, but it does at least hold out the prospects of further improvements ahead, which is encouraging. But there is still little chance of the Bank of Korea coming out of hibernation any time soon. For that, we need to see more confirmation of a turn in the growth data (recent export figures were not encouraging). We also need to see some more firmness in pricing, with core inflation pushing closer to 2.0%YoY. At 0.9%YoY currently, this is unlikely before mid-2019 (ING forecast next rate hike in 3Q19).

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap

2 October 2018

Good MornING Asia - 2 October 2018 This bundle contains 4 Articles