Korea: Industrial production fell for a second month

Service and construction activity increased but couldn't stop the decline in the all-industry production index as manufacturing activity fell in August. Solid consumption and facility investment should lead the current quarter's growth, but we then expect a sharp deceleration. We expect only a 0.1%QoQ GDP gain in 3Q22 (vs 0.7% in 2Q22)

| -1.8% |

Industrial Production%MoM, sa |

| Lower than expected | |

All industry production fell for a second month due to weak manufacturing activity

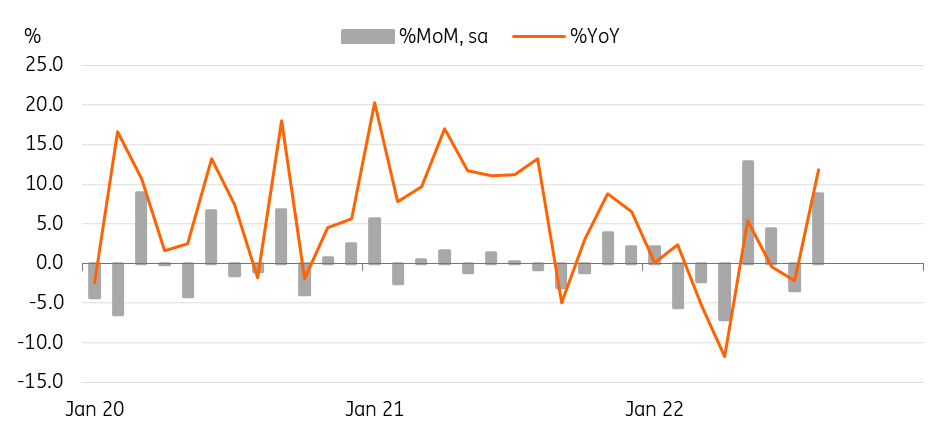

Industrial production dropped by 1.8% MoM (sa) in August, which was a bigger fall than had been expected (-1.3% in July and -0.8% market consensus), recording its second monthly decline. By industry, automobile production continued to gain solidly (8.8%) with improving global supply conditions helping suppliers to fill gaps in existing orders. But other major export items such as semiconductors (-14.2%) and petrochemicals (-5.0%) fell, suggesting that overall global demand conditions worsened.

Semiconductor production dropped for a second month and was also accompanied by a worrying accumulation of inventories. Usually, this leads to a downward cycle for semiconductors. We expect a weak semiconductor performance in the coming quarters. Meanwhile, economic reopening appears to have supported activity in services. Social/welfare services declined (-1.3%) as the Covid situation improved, but wholesale/retail sales (3.7%) and leisure services grew solidly.

Manufacturing IP fell for a second month in August

Equipment investment and construction rebounded in August

There was a positive message in the investment component of this data. Equipment investment rebounded 8.8% in August. In addition, the forward-looking machinery orders series also showed gains, mainly driven by the IT sector. It seems as if despite the downturn in the semiconductor cycle, manufacturers continue to expand their investment in advanced technologies.

For construction investment, both engineering and residential construction rose for the first time in three months while construction orders fell sharply reflecting the sluggish real-estate market in Korea.

Investment rebounded in August

The growth outlook and the Bank of Korea policy reaction

Based on today’s weaker-than-expected industrial production data, we expect 0.1% QoQ growth in 3Q22 (vs 0.7% in 2Q) and have downgraded our annual GDP forecast for 2022 to 2.5%YoY. In addition, with downbeat forward-looking data, we believe the probability of recession is growing rapidly. Yesterday’s business survey outcomes were weak, with manufacturing sentiment deteriorating to its lowest level since October 2020. Also, we expect a sluggish housing market in the coming quarters as a result of tightened liquidity conditions backed by today’s weak construction order data. Thus, we think growth for the next two quarters will likely contract with both weak domestic and external demand.

Despite the recent poor performances in activity data, we believe that the Bank of Korea (BoK) will still put its policy priority on price stabilization. And we expect a 50bp hike at the BoK's October meeting. But the weak growth conditions will eventually slow the BoK’s tightening actions. And growing concern about recession, together with slowing inflation, should stop the BoK's rate hike cycle by early next year.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap