Korea finishes 2020 with strong growth

4Q20 GDP exceeded the consensus with support from government spending. 2021 is going to have to rely far more on the private sector

| 1.1% |

4Q20 GDPQoQ% |

| Higher than expected | |

Full-year GDP declines 1%

To finish 2020 with GDP growth only down one percent for the full year, during the worst natural global catastrophe in modern times, is actually a pretty good result for Korea. Certainly, few bookmakers would have given you odds on such a modest decline during the first quarter of the year, when Korea was bearing the brunt of the Covid outbreak, not just in Asia but globally.

Two strong quarters of growth in 3Q and 4Q follow declines of only 3.2% in 2Q and 1.3% in 1Q. It is really these modest declines earlier in the year, as much as the subsequent GDP growth rates that have set up Korea for this very commendable full-year outcome and set the scene for reasonable performance in 2021.

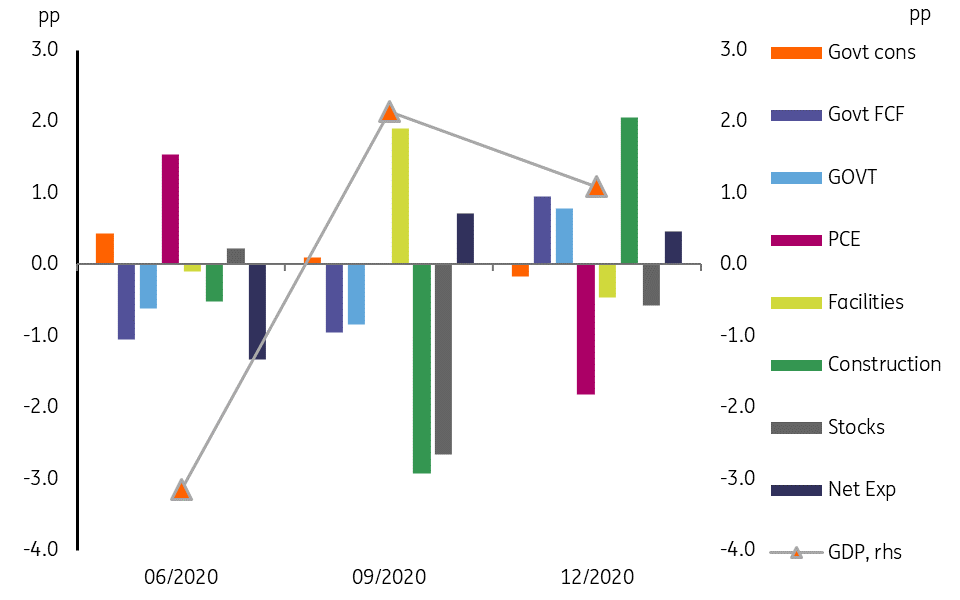

Contribution to QoQ% growth

Korea's Government deserves some of the credit

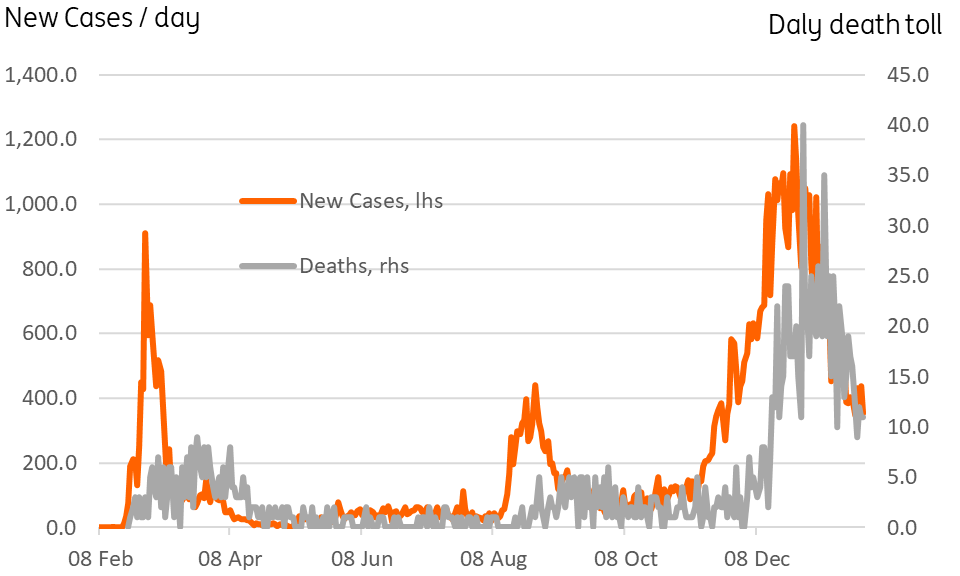

The Korean Government deserves some credit for this GDP performance, which looks considerably better than almost anywhere in Europe or the US. Curbing the daily case numbers through aggressive test trace and isolation has worked for Korea. But only because it never let the numbers get too high. This policy would never have worked with case numbers in the 10,000s. At their worst, daily case numbers only briefly exceeded 1,000 and are now back below 400. Still, it is too early to be complacent and there is a long way to go before Korea can consider this Pandemic under control.

Korea daily Covid cases and deaths

Government spending doing much of the heavy lifting

Government support is also evident in the contribution to growth figures, where government fixed capital formation provided about 1.0pp of the 1.1% QoQ headline total for GDP. This was more than the 0.8pp private sector fixed capital formation, and private consumer expenditure delivered a drag of around 1.8pp - reflecting the economic damage that social distancing measures deliver.

Net exports also provided a small boost of about 0.5pp. We would anticipate net exports continuing to provide modest support in the quarters ahead, helped by the positive semiconductor cycle and global demand for electronic products, though this will probably be dampened by some recovery in private consumer spending and consequently in rising imports.

Growth in the coming quarters is likely to slow back below 1.0%QoQ, probably into a 0.5-0.7% QoQ range depending on how subsequent waves of the pandemic play out both locally and globally. And this will also be affected by the speed of rollout of vaccines and their effectiveness against new virus variants. On this, recent news suggests taking a cautious view. Delivery of vaccines in Asia is lagging what is taking place in the West, and the evolution of new virus variants which current vaccines may not provide full protection against provides further grounds for caution.

Nevertheless, assuming that we see a stronger second half in 2021 (taking the pandemic into account), then we can see Korea achieving 2.6% GDP growth for full-year 2021. This will likely be accompanied by some recovery in the rate of inflation. Headline inflation is currently only 0.5%YoY, but which could rise above 1.0% by the April release, and come close to 2.0% by July, mainly thanks to base effects, a little bit of oil and other commodity price increases, and also some upward margin readjustment as the economy slowly moves towards full re-opening.

Despite this, we don't think the Bank of Korea (BoK) will be in a huge hurry to start tightening rates. High levels of household debt driven by house price acceleration mean that the BoK will have to be very sure the economy is resilient before taking this first step towards tightening. We don't expect this until early 2022.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap

26 January 2021

Good MornING Asia - 27 January 2021 This bundle contains 4 Articles