Korea: Consumer confidence holds despite increasing global risks

With higher inflation expectations, the Bank of Korea is likely to resume policy rate hikes in May

| 103.2 |

Composite Consumer Sentiment Index |

Consumer sentiment index edges up

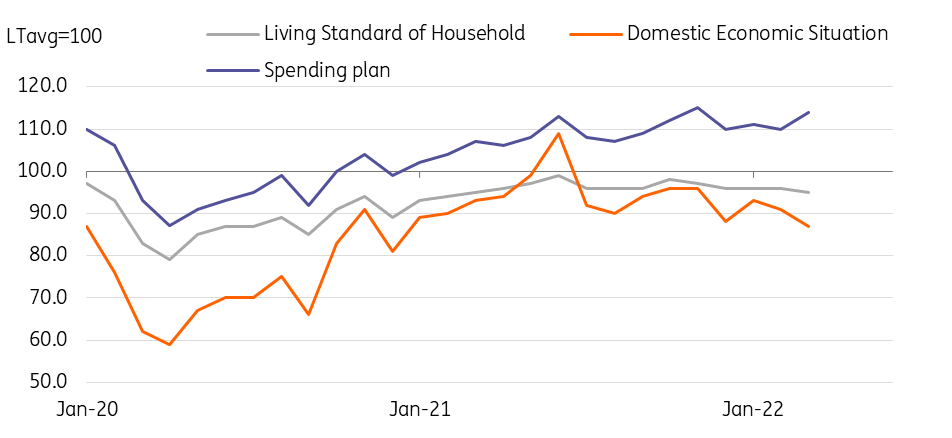

Bank of Korea released the March Consumer Sentiment Index (CSI) which showed that consumer confidence held up relatively well despite increasing global risks, rising from 103.1 in February to 103.2 in March. Given the survey was conducted during the third week of March, the early impact of the Russia/Ukraine war has been reflected. Looking at the details, consumers were concerned about the ongoing war and its aftermath as the current status (-4) and outlook (-4) for economic conditions deteriorated. However, consumers appeared to be more confident in their spending, presumably as social distancing eased and amid optimism about real estate market policy changes. Spending plans for the next six months on durable goods (+2), apparel (+2), eating out (+3), travel (+4), and transportation (+5) are all up. One interesting note is that housing price expectations rebounded strongly (+7), as the government is planning to soften some taxation rules and housing market regulations.

While consumers are concerned about the economic situation, future spending plans haven't been dampened

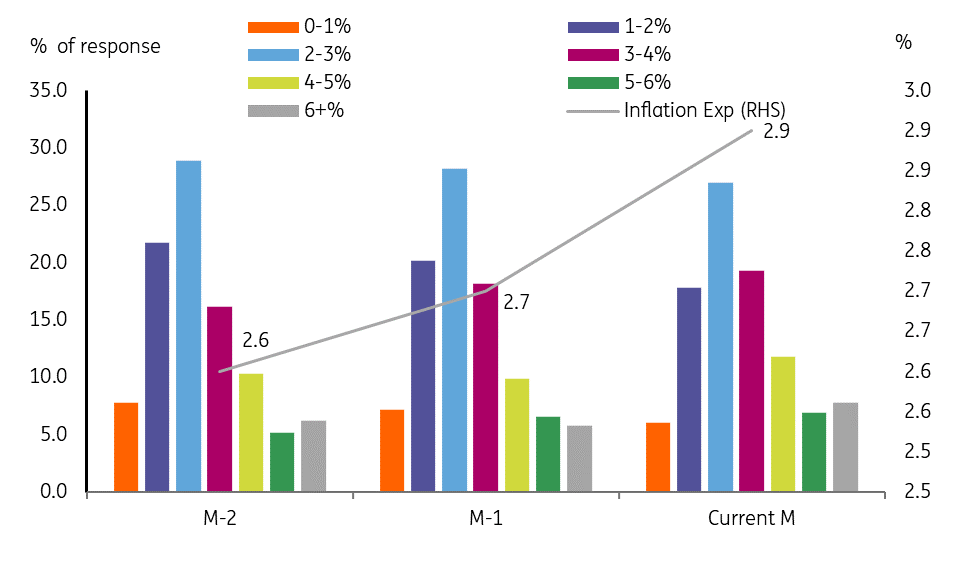

Inflation expectations are on the rise

Meanwhile, inflation expectation for the next 12 months rose to 2.9% (vs. 2.7% in February), reaching the highest level since 2014. The government’s efforts to curb inflation continues, as KEPCO, the largest electric utility in South Korea, announced that it would freeze the adjusted unit fuel cost for the second quarter of 2022 despite the recent surge in commodity prices. Yet, the electricity bill will go up 6.9won per khw from April, reflecting last December’s price hike decision which was based on climate change and other costs.

Inflation expectation is increasing

Monetary and fiscal policies will add more pressures on KTBs

With inflation expectations hitting a recent high and with clear signs of inflationary pressures, the Bank of Korea is expected to resume rate hikes in May. The new Governor candidate, Changyong Rhee, will begin the confirmation process soon, but he is likely to miss the 14 April Monetary Policy Committee meeting. Regardless of whether Rhee joins or not, the Bank of Korea is expected to stay put in April to monitor how the previous rate hikes have affected the economy and to assess how the ongoing war is progressing in Eastern Europe, while maintaining its hawkish stance

On 28 March, President Moon Jae-in and President-elect Yoon Suk-yeol met and agreed on the need for extra budget. Details have not been delivered yet, but both parties will more than likely push the bill ahead of the 1 June local elections. President-elect Yoon and the transition committee favour the restructuring of current expenses, but in reality, there is no alternative other than the issuance of Korean Treasury Bonds (KTBs), unless the size of the extra budget would be substantially smaller than what President-elect Yoon pledged (50 trillion Korean won) during his campaign. Macro policy conditions will put more pressure on the KTBs for a while.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap