Japan’s data surprises on the upside

Stronger-than-expected industrial production and solid labour market data suggest Japan's economy continued to recover in the current quarter. A further easing of border restrictions and resumption of domestic travel aid programmes will support next quarter's growth as well. Thus, we upgrade 2022 GDP growth to 1.6% YoY from 1.2% previously

| 2.7% |

Industrial Production% MoM, sa |

| Higher than expected | |

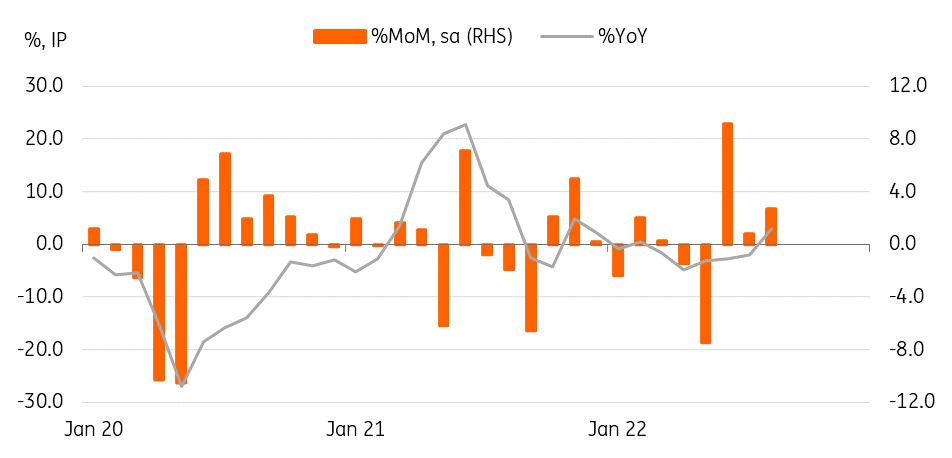

Industrial production recorded a third monthly gain in August

Industrial production in August rose 2.7% month-on-month seasonally-adjusted (vs 0.8% in July), beating the market consensus of 0.2%. In three-month sequential terms, IP rebounded quite sharply by 4.6% from -2.7% in June, suggesting that quarterly manufacturing growth in GDP is highly likely to turn positive. Machinery (3.5%) and iron/steel (3.6%) were the main factors behind the strong monthly gain while automobiles (-4.0%) and petrochemicals (-2.4%) dropped. Electronic parts and devices, meanwhile, recorded a second monthly decline (-6.3%), which was also shown in today's Korean IP data, thus the regional weakness in the IT sector adds to concerns about weak global demand in the coming months.

Japan IP recorded a third monthly gain in August

Retail sales increased 1.4% MoM sa in August

In a separate data release, retail sales rose firmly, by 1.4% MoM sa in August (vs 0.8% in July), beating the market consensus of 0.2% as well. With easing mobility rules, summer holiday-related spending appears to have increased. This encouraged further consumption during the current quarter despite higher inflation and weak JPY conditions.

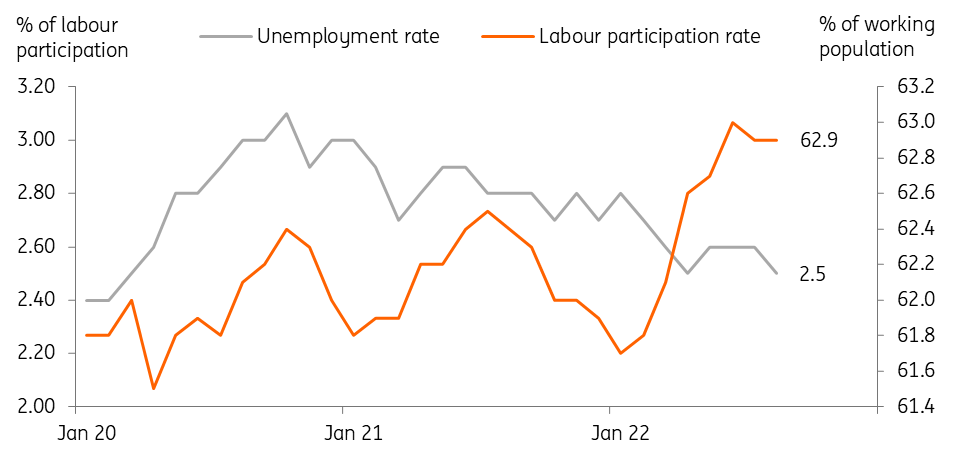

Labour conditions continued to tighten

The jobless rate edged down to 2.5% in August after having stayed at 2.6%. This was in line with the market consensus. The labour participation rate was unchanged at 62.9%. In addition, the job-to-application ratio improved to 1.32 (vs 1.29 in July).

Labour conditions improved in August

The growth outlook and the Bank of Japan policy reaction

Given stronger than expected industrial production and retail sales, we have upgraded third and fourth quarter GDP to 0.5% quarter-on-quarter sa and 0.4%, respectively. We believe that easing Covid restrictions will boost service activity and service jobs for a while, which will be the main driver behind the fourth quarter growth. Also, given the weak Japanese yen, incoming travel demand could work favourably for the nation's economy if border restrictions are lifted.

The latest data releases from Japan point to a solid recovery in the near future and are a positive sign for the wage growth that the Bank of Japan is seeking. Japan is reopening its economy at a slower pace than other Asian countries and the reopening effects are just kicking in, which should be the main driver for the positive outlook for the second half of the year. However, as the headwinds of the global recession grow, the BoJ will take its time to determine whether Japan can still deliver solid outcomes in a sustainable way.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap