Japan: labour market remains tight while consumption begins to slow

Labour market conditions tightened further last month, but we don't see any signs of wage growth yet. Meanwhile, goods consumption is weakening. Thus, the Bank of Japan will likely stick to its policy stance at its December meeting, despite expectations of higher inflation over the next few months

| 2.6 |

Jobless rate |

| Higher than expected | |

Labour market conditions remain solid, but there are still no imminent signs of wage growth

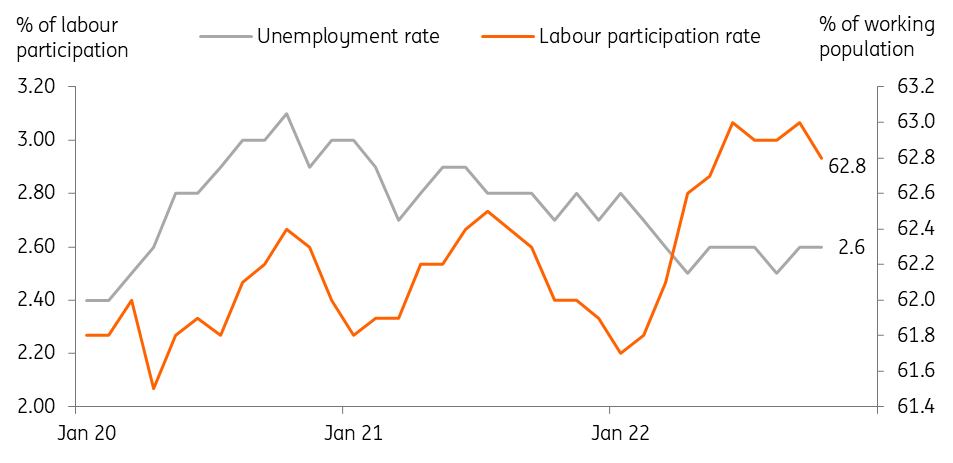

The unemployment rate in Japan stayed at 2.6% in October for the second consecutive month, slightly above the market consensus of 2.5%, but the job-to-application ratio edged up to 1.35 as expected. We believe that the labour market will continue to recover over the next few months. Hospitality service jobs are likely to grow as the number of international and domestic tourists rise, while manufacturing employment will likely turn weak due to the weak manufacturing outlook suggested by muted PMI and export data. Wages in services tend to be lower than in manufacturing, so the unemployment rate is likely to fall, but we do not expect overall wage growth.

The jobless rate remained low in October

Retail sales rose marginally

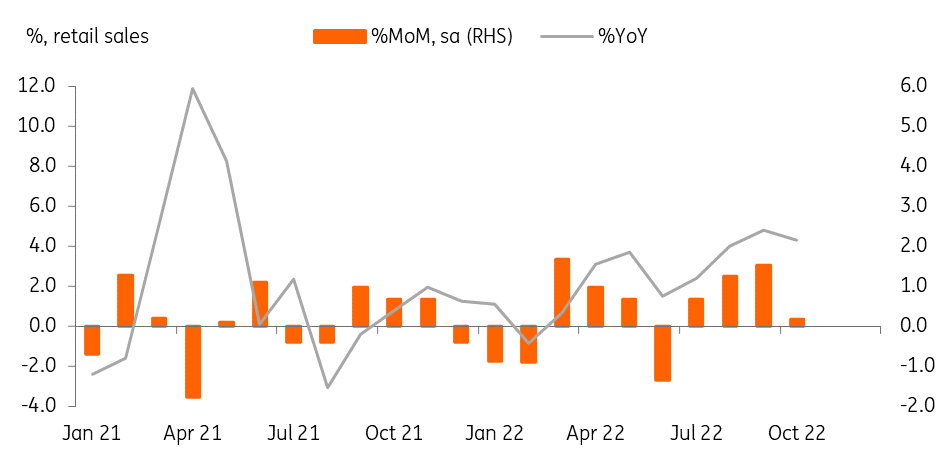

Retail sales grew 0.2% month-on-month seasonally adjusted in October (vs a revised 1.5% in September) but fell short of the market consensus of 1.0%. Looking at the details, apparel sales rose the most (3.9%) and food/beverage sales also rose solidly (1.8%). However, durable goods, such as motor vehicles (-6.8%) and household machines (-0.4%), and fuel (-0.7%) declined, probably due to higher prices. Retail sales have been solid in recent months, mainly due to the easing of Covid restrictions and supply constraints on car production. However, we believe that goods consumption will likely turn weak over the next few months due to a rapid rise in prices, while services consumption boosted by tourism is likely to continue its recovery.

Retail sales growth slowed in October

The Bank of Japan will stay pat at its December meeting

In Japan, forward-looking price indicators suggest a further rise in inflation as we approach the end of the year, but the stabilised Japanese yen and global commodity prices will likely lighten the burden on inflation next year. The recent sharp rise in inflation is mainly driven by supply-side factors, so it won't change the policy stance of the Bank of Japan.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap