Japan: industrial production falls but retail sales hold up

Although monthly activity data has been mixed and the outlook is cloudy, consumption and facility investment are expected to drive moderate growth in the third quarter of 2022

| -1.6% |

Industrial production%MoM, sa |

| Lower than expected | |

Industrial production falls for the first time in four months

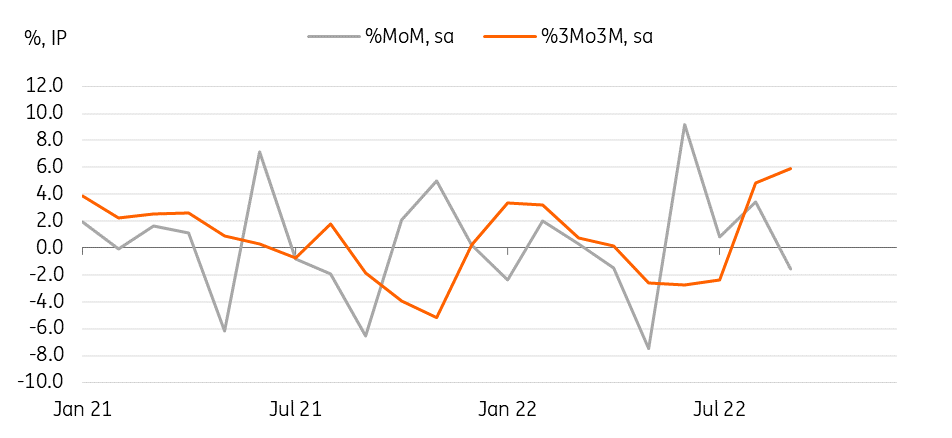

Industrial production declined -1.6% month-on-month seasonally-adjusted in September (vs 3.4% in August), weaker than the market expectation of -0.8%. This was mainly due to a sharp decline in motor vehicle production (-12.4%) – we think auto production took somewhat of a breather after strong gains over the past few months. Meanwhile, the upward trend of IT equipment such as electrical machinery and information and communication equipment continued in September, suggesting that global IT investment demand was rising until recently. However, the near-term production outlook is cloudy as companies have cut their production plans for October, with a -0.4% drop in October compared to a 3.2% gain in the previous month.

September IP fell but the sequential trend improved compared to the previous quarter

Retail sales rose more than expected in September

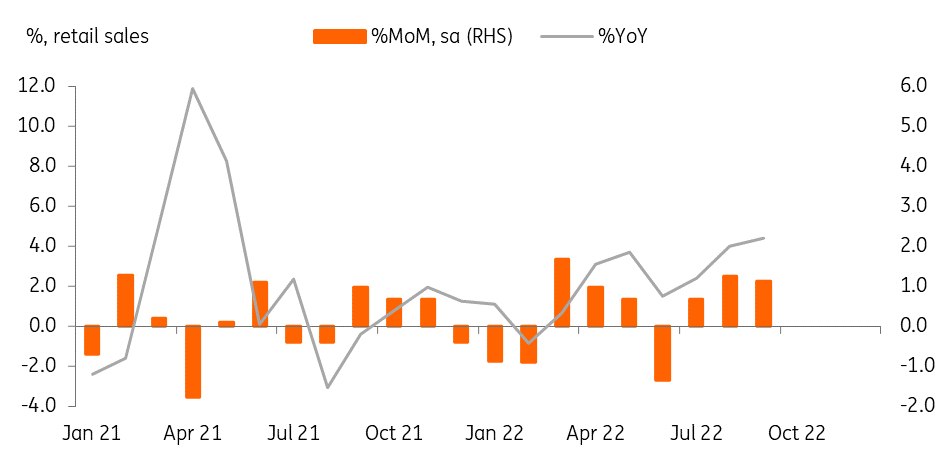

Retail sales rose stronger than expected in September, by 1.1% vs 1.4% in August and a 0.8% market consensus. All items gained except apparel which recorded the fourth month of decline. Motor vehicles and household machinery gained the most, by 11.1% and 14.6% respectively. Despite higher inflation, pent-up demand appeared to boost retail sales. Since the beginning of October, the government has been expanding its travel subsidy programme, which is having a positive impact on service consumption.

Retail sales continued to rise in September

Third quarter GDP outlook

Recent activity outcomes including today's release support our view that third-quarter GDP growth will decelerate to 0.5% quarter-on-quarter seasonally adjusted from the previous quarter's increase of 0.86%. Household consumption is expected to rise but at a slower pace mainly due to higher inflation, while facility investment in transportation and machinery will likely recover. However, net exports contribution should drag on growth as a weak Japanese yen and higher commodity prices significantly hurt terms of trade.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap