Poland’s industrial activity surprises to the upside as inflationary pressures mount

Industrial output in Poland is supported by a diversified production structure. Companies are still able to find customers despite higher prices. We think the chances of a rate hike for Poland in November have increased

In September volume of Poland's industrial production rose by 8.8% YoY, exceeding the consensus forecast (8.2%). Coal mining accelerated strongly, with production rising by 19.6% YoY. This is supported by increasing global demand and prices. Coal is still Poland's primary energy source, and the next one, gas, has become more expensive.

But we also see some other reasons for the solid production growth. Poland's diversified industry is doing better than car monocultures in neighbouring countries (car factories in Czechia were closed in 4Q21 due to supply disruptions). Production of clothes accelerated to 22.3% YoY after 14.1% growth in August. Manufacturers are probably increasing capacity in the country to deliver their orders given rising shipping costs and lengthening delivery times worldwide.

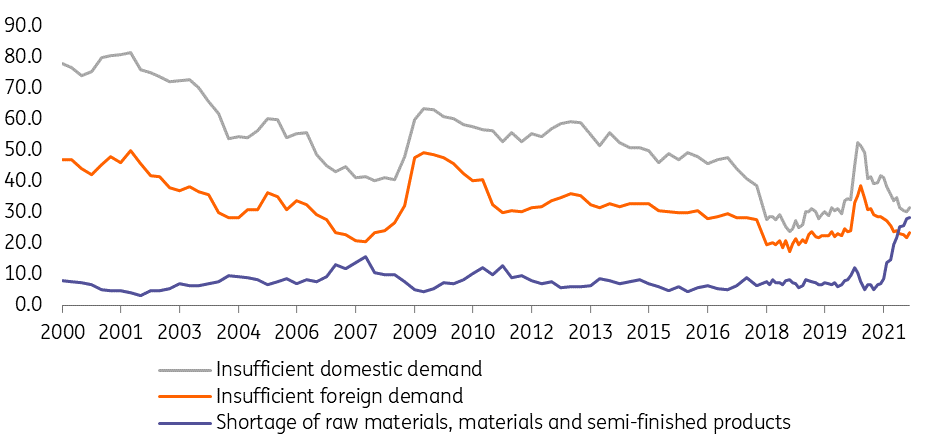

On the other hand, the automotive sector is deteriorating. In September car production fell 17.3% YoY after a 12.9% decline in August. Problems with the availability of microprocessors are ongoing, forcing some companies to suspend operations. This generates further disruption to logistics chains, auto production is one of the most logistically complex manufacturing processes. In September the share of manufacturing companies that indicated a shortage of raw materials, supplies and semi-finished products as a barrier to their operations increased to 28.3%, the highest in the history of the CSO survey.

Manufacturing: Factors limiting activity

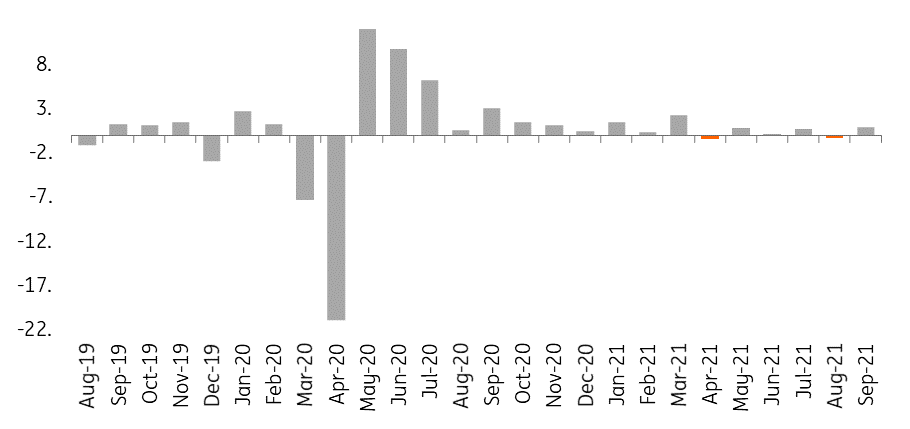

The YoY production results are affected by the base effects and often by differences in the number of working days. Therefore, it is better to use seasonally adjusted MoM changes to assess current trends. These, at the aggregate level, also point to an improvement in manufacturing after the weaker recent months. In September, production rose by 0.9% MoM, which was the best result since March this year. Poland's aggregate production may benefit from its highly diversified structure, especially compared to its regional peers.

Industrial production (%MoM, seasonally adjusted)

As demand is sustained, companies are able to pass on increasing costs to the prices of final products. In September, producer price inflation (PPI) rose again, to 10.2% YoY from 9.6% in August. Companies are still able to find customers despite higher prices, which suggests that inflationary pressure in the economy is likely to stay for longer. In our view, today's industrial and PPI results increase the likelihood of another rate hike in Poland in November.

We do not yet know all the data for September, but we preliminary estimate 3Q21 GDP at around +5% YoY.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap