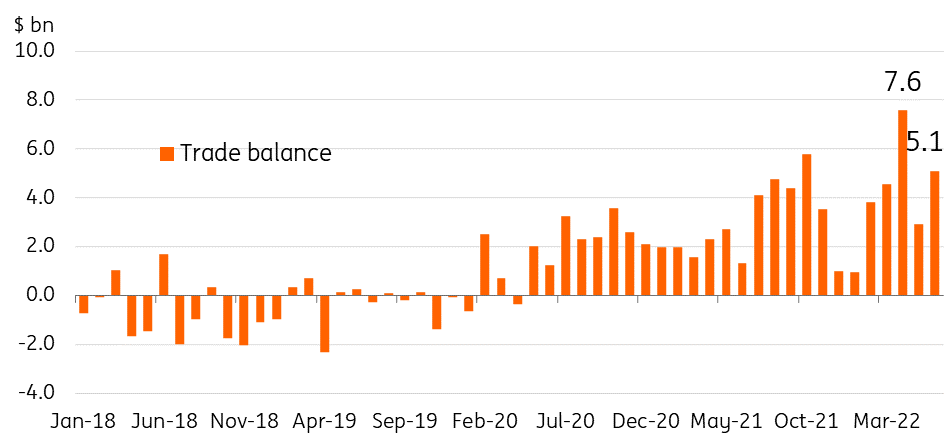

Indonesia: Trade surplus widens again as palm oil exports resume

Indonesian exports surged by 40.7% in June, resulting in a very healthy trade surplus

| +$5.1bn |

June trade balance |

| Higher than expected | |

Palm oil exports help boost exports again

Indonesia’s trade report showed a sharp resurgence in exports, jumping by 40.7% in June. The main driver for the strong pickup in outbound shipments was the resumption of palm oil shipments. Previously, authorities had banned the export of palm oil and its derivatives, weighing heavily on exports for the duration that the ban was in place. Since then, authorities have given the green light for palm oil exports to resume, translating to an immediate impact on the trade balance.

Meanwhile, imports gained as expected, rising by roughly 22% due to pricey energy imports and resurgent demand driven by the economic reopening. Overall, the trade balance hit $5.1bn, bouncing back from last month’s $2.9bn.

Palm oil export resumption translates to immediate gains on trade balance

Trade surplus a boon to the rupiah, but Bank Indonesia could still hike next week

Hefty trade surpluses this year have helped insulate the Indonesian rupiah (IDR) to some extent, allowing Bank Indonesia (BI) a little more breathing room to keep rates untouched in 2022. The resumption of palm oil exports should help deliver sizable trade surpluses in the near term, which could be supportive of IDR as well.

Despite this outlook, we believe that BI will finally consider raising policy rates next week given recent developments on central bank policy. Monetary authorities in the region and around the world have been ratcheting up tightening efforts in response to expectations of aggressive rate hikes from the US Federal Reserve. As such, BI could consider this development and opt to carry out a modest 25bp rate hike next week to help defend IDR from potential financial outflows.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap