Indonesia’s trade surplus narrows in March

Indonesia managed to post a trade surplus in March, but it was much lower than the previous month's

| $2.9bn |

March trade balance |

| Lower than expected | |

Trade surplus narrows

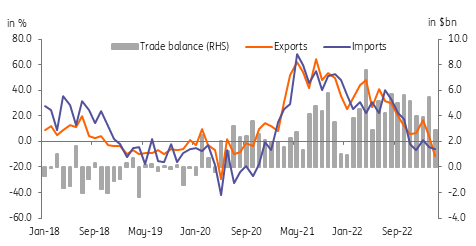

Indonesia posted yet another month of trade surplus in March, although a drop in exports meant it was smaller than expected. Exports fell 11.3%, slightly better than expected but weighed down by contractions in exports of mining products (-4.6% year-on-year), oil and gas (-4.8%YoY) and manufacturing (-13.7%YoY).

Imports also contracted but only by 6.3%YoY, better than expectations of a 13.5%YoY drop. Imports were weighed down by sliding inbound shipments of raw materials (-11.7%YoY) and consumption goods (-2.9%YoY) however capital goods posted a sizable gain in capital imports (18.5%YoY) which bodes well for Indonesia’s productive capacity down the line.

As a result, the overall trade balance stayed in surplus but narrowed considerably from $5.5bn to $2.9bn.

Trade surplus dips to $2.9bn

Fading trade surplus

Indonesia banked on sizeable trade surpluses last year to support the Indonesian rupiah (IDR). Fading global commodity prices will likely mean that we can expect a substantial narrowing of trade surpluses this year. Despite the fading of this key support to the currency, the IDR has managed to stabilise on the back of renewed financial market flows as domestic inflation moderates.

With the currency enjoying a spell of stability and occasional strength, the Bank of Indonesia (BI) has had less incentive to push interest rates higher and we could see the central bank on hold in the near term. Furthermore, should inflation slow further and the IDR remain stable, we could see BI consider a potential shift in stance to help support the ongoing economic recovery.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap