Indonesia on hold again to support gradual recovery

Bank Indonesia kept policy rates untouched as the recovery is seen as gradual

| 3.5% |

Policy rate |

| Higher than expected | |

Central bank left rates unchanged to support gradual recovery

Bank Indonesia (BI) retained its accommodative stance primarily to help support the fledgling economic recovery. BI Governor, Perry Warjiyo, noted that global growth momentum hit a speed bump mid-year as the Delta variant spread across most countries. Meanwhile, domestic growth is expected to be “gradual” and the central bank retained its GDP forecast of 3.5% - 4.3%, slightly below the official expectation for the 3.7% - 4.5% range set by the national government.

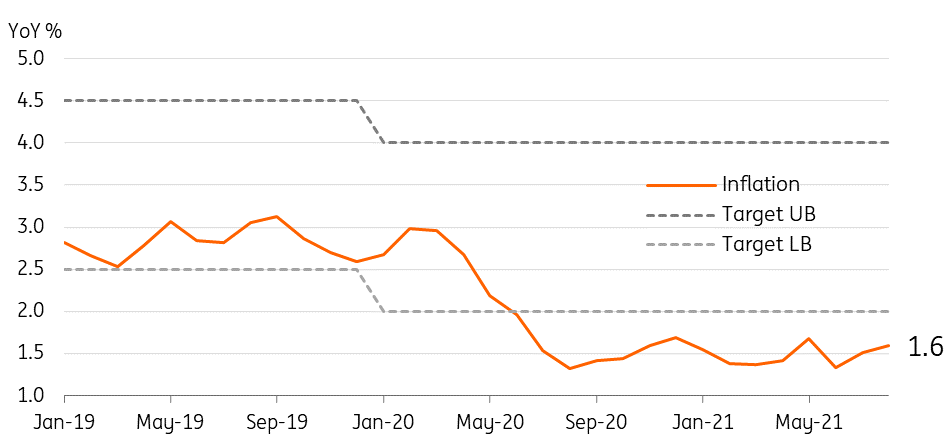

BI has room to keep rates unchanged with inflation below target

Export surprise to support external account and IDR in near term

Warjiyo remains confident that Indonesia's rupiah will stabilise “in-line with fundamentals” in the coming months. The surprise outperformance of the export sector will lend some support to the external account and in turn bolster IDR as the trade surplus swells. Despite this recent positive development, Warjiyo kept his previous current account expectation for the deficit to settle between 0.6% - 1.4% of GDP. BI reiterated its stance to take necessary measures to keep the current account stable when needed, with triple intervention likely called into play during bouts of uncertainty.

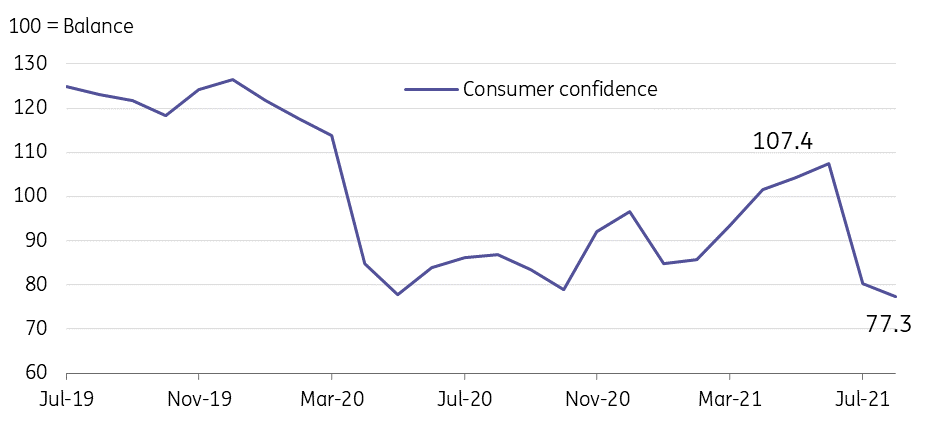

Momentum hit by Delta wave but rebound expected as economy reopens

More upbeat on economy but expect support for longer

The recent Delta Covid-19 wave forced authorities to deploy mobility restrictions in July and part of August, weighing on overall growth momentum. With daily infections now more under control, the economy has gradually reopened with authorities hoping to get growth back on track. With inflation below the central bank’s 2% - 4% target, we expect Governor Warjiyo to have all the necessary space to retain his “pro-growth” stance to support the recovery. We believe that BI will keep rates untouched for the balance of 2021 given the current inflation and growth situation.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap