Indonesia: Inflation back within target, could be a factor for monetary policy in 2022

January inflation at 2.2%, moving back within target after 2021 miss.

| 2.2% |

January CPI inflation |

| Higher than expected | |

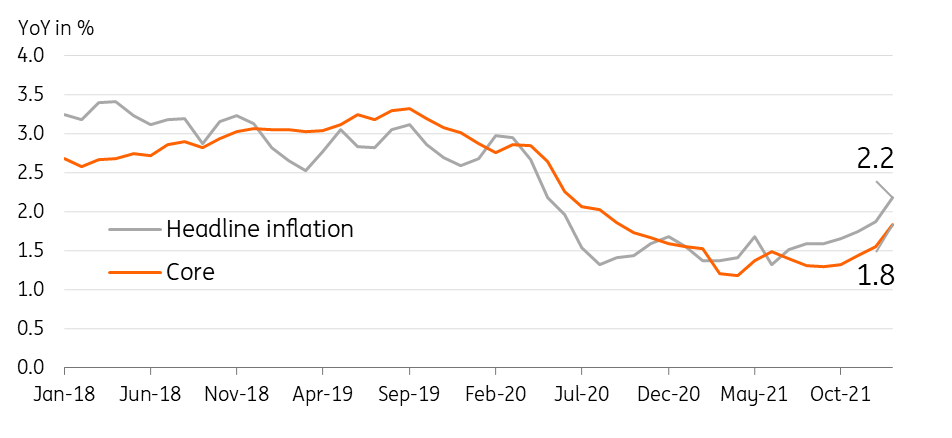

January headline inflation climbs to 2.2%

After sliding below target for all of 2021, inflation settled back within the central bank’s 2-4% target band. Base effects played a part in the pickup in prices but so did a recovery in domestic demand, reflected in an expansion for 3 straight months now. As a result, core inflation is also on the rise, settling at 1.8% in January. We forecast inflation to continue to accelerate in the coming months, driven by supply side issues and improving domestic demand conditions. Inflation could peak at 3.7% by the third quarter.

Inflation back within target, likely to play a role in the timing of any BI rate hike

Inflation to be a factor in 2022?

Below-target inflation in 2021 allowed Bank Indonesia (BI) to maintain an accommodative bias last year. BI Governor, Warjiyo, operated under a “pro-growth” stance in 2021, citing the need to support the fledgling economic recovery. This year, we predict inflation to accelerate to a point where monetary authorities may need to consider a pronounced shift in stance, sooner rather than later. Mounting pressure on IDR in anticipation of the projected Fed rate hike will only heighten price pressures in the coming months, driving up inflation further.

Thus we believe that inflation will likely play a more prominent factor in monetary policy this year, with accelerating inflation and a weaker currency the trigger points for an eventual rate hike by BI by 2Q.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap