Indonesia’s central bank surprises with rate hike

Bank Indonesia has unexpectedly hiked rates in a preemptive move

| 3.75% |

Policy rate |

| Higher than expected | |

Surprise surprise... BI finally hikes rates

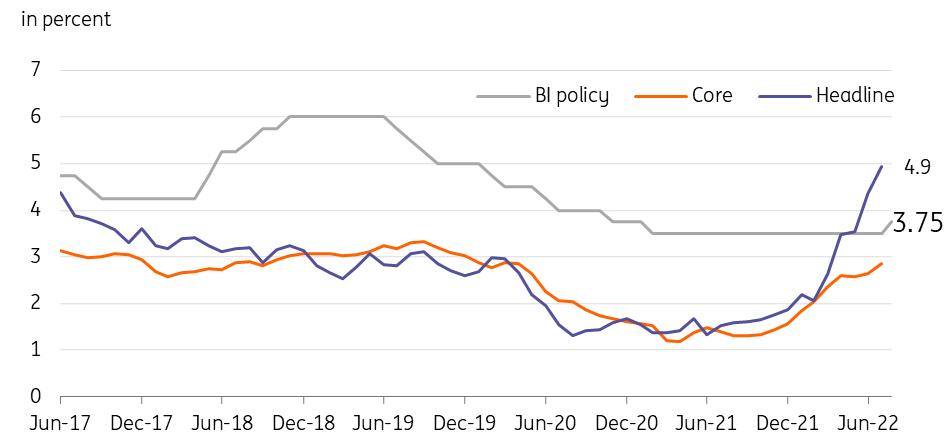

Bank Indonesia (BI) unexpectedly raised its policy rate by 25bp today. BI Governor Perry Warjiyo carried out a preemptive hike in anticipation of a planned price increase for subsidised fuel. The central bank expects growth to settle at the top end of their 4.5-5.3% year-on-year forecast while headline inflation is forecast to exceed 5%.

BI tightens as headline and core inflation sustain rise

BI likely not done for the year

BI finally hiked after staying on hold for the whole of 2022, confident that policy tightening would not derail the economy's recovery. BI also made particular mention of "high" food inflation and any future tightening could be triggered if food prices stay elevated. We expect at least two more rate hikes by the central bank this year.

BI indicated it would be active in buying government bonds on the long end while selling shorter-dated bonds resulting in a flatter yield curve. Meanwhile, the Indonesian rupiah (IDR) could gain support from the surprise rate hike in the near term and could strengthen further should Indonesia's trade surplus remain sizable.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap