Indonesia: Central bank keeps rates unchanged as expected

Bank Indonesia kept its policy rate steady but trimmed its outlook on growth

| 3.5% |

BI policy rate |

| As expected | |

Central bank pauses again despite dimming outlook

Bank Indonesia (BI) left its policy settings untouched despite below-target inflation and a dimming outlook on growth. BI trimmed its growth projection for the year to 4.1-5.1% (previously at 4.3-5.3%) as authorities extend partial lockdown measures to the first week of May. New Covid-19 infections remain elevated even as the government continues to deploy vaccines to quell the spread of the virus, a development that is likely weighing on consumer sentiment. Meanwhile, the currency has come under pressure recently in reaction to developments in the global bond market, prodding Governor Perry Warjiyo to settle for a pause at this meeting to lend support to the Indonesian rupiah.

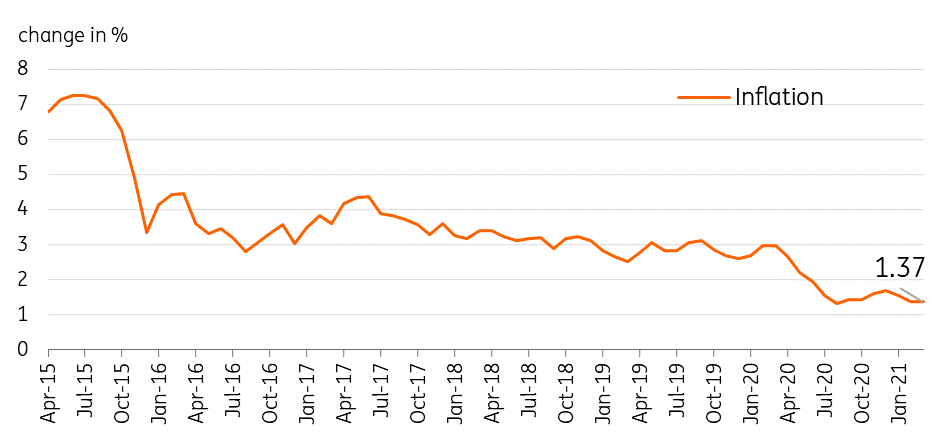

Indonesia inflation

On hold until further notice

BI continues to urge commercial banks to pass on lower borrowing costs to consumers, unveiling several measures to help bolster bank lending for automotive and home loans. Despite these recent efforts, the central bank reported that loan growth remains in the red (-4.1%) in March although monetary officials point to signs that lending activity may bounce back in the coming months. BI will likely be on hold until pressure on the currency dissipates substantially with the central bank likely to push other lending measures to support growth in the near term.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap