Indonesia: Central bank hikes 50bp to help steady the currency

Bank Indonesia has hiked policy rates by 50bp to shore up the rupiah

| 4.75% |

7-day Reverse Repurchase rate |

| As expected | |

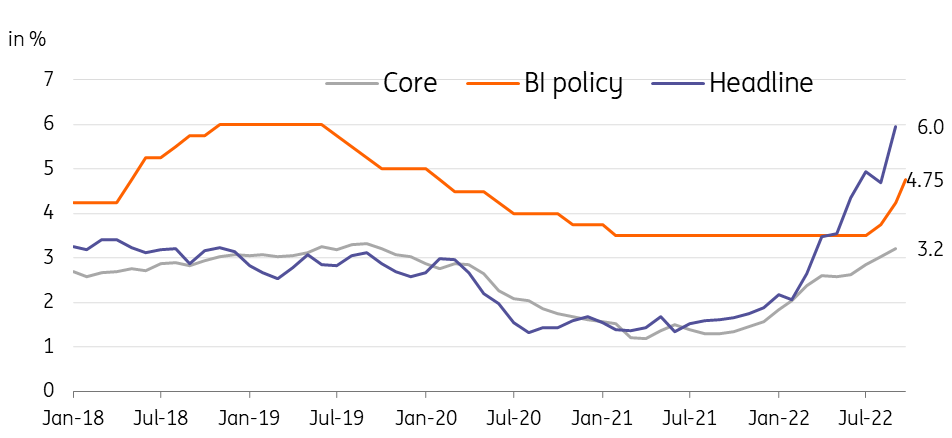

BI tightens by 50bp as expected

Bank Indonesia (BI) hiked policy rates by 50bp as expected today. The central bank continued to tighten aggressively to shore up the currency which has faced renewed pressure of late (down 1.73% in October).

The Indonesian rupiah (IDR) had been relatively stable for the early part of the year, aided by hefty trade surpluses. But the heightened risk-off tone and accelerating inflation have the currency currently on the back foot.

BI ramps up rate hikes as inflation heats up

Far from done

BI was a relative latecomer to the central bank rate hike club and we believe that Governor Perry Warjiyo's work is far from over. Inflation will likely pick up further in the coming months which should ensure BI stays hawkish to close out the year. Additional BI rate hikes will also be needed to maintain FX stability, especially with markets pricing in aggressive rate hikes by the US Federal Reserve.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap