Indonesia’s central bank extends pause as currency steadies

Bank Indonesia has left the policy rate untouched at 5.75%

| 5.75% |

Bank Indonesia policy rate |

| As expected | |

No surprises

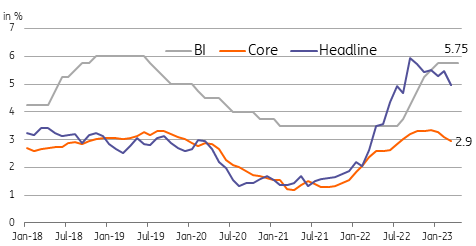

Bank Indonesia (BI) kept policy rates unchanged at 5.75% today, as expected, against the backdrop of moderating price pressures and a stabilising currency. Both headline and core inflation have slowed since peaking late last year, allowing the central bank to pause at its meeting last February. BI expects the global recovery to continue, retaining its 2.6% year-on-year growth forecast. The central bank also retained growth expectations for the domestic economy (4.5-5.3%YoY) with the recovery driven by consumption, investment outlays and a robust trade sector.

Meanwhile, the recent appreciation spell of the Indonesian rupiah (IDR) bodes well for BI’s fight to lower inflation, and the central bank expects headline inflation to return to target earlier than previously forecast.

BI extends pause for third consecutive meeting

BI edging closer to a pivot?

The central bank opted to pause again today but current trends point to a potential shift in tone from Governor Perry Warjiyo over the coming months. Inflation has continued to moderate with the core measure right below the midpoint of the central bank’s policy band. Meanwhile, the IDR is currently outperforming regional peers on renewed foreign inflows to the bond market. Against this backdrop, our base case would be for Warjiyo to extend his pause until the third quarter before carrying out rate cuts to help support the ongoing economic recovery.

However, should inflation slow at a more pronounced pace, the IDR maintain its stability and domestic growth prospects dim, we could see the BI bringing forward its rate cut timing to the late second quarter.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap