Indonesia’s central bank bucks rate hike trend amid tame inflation

Bank Indonesia kept rates untouched noting that inflation remains within target

| 3.5% |

BI policy rate |

| As expected | |

Bank Indonesia holds rate steady despite global tightening cycle

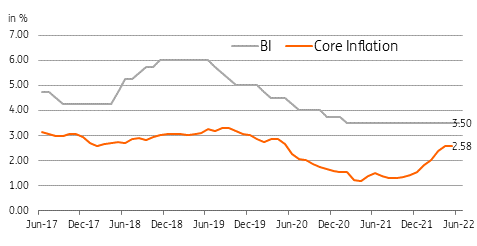

Indonesia’s central bank kept its policy rate at 3.5%, in line with market expectations. Bank Indonesia Governor Perry Warjiyo pointed to manageable inflation as the main reason for the pause as the central bank hopes to deliver additional support for the economy’s recovery. BI expects the recent uptick in inflation to weigh on global growth, likely a factor in its decision to extend support to the economic recovery.

Core inflation is currently at 2.6%, comfortably within BI’s inflation target for the year. Subsidies and the recent palm oil export ban have helped keep a lid on price pressures of late, but recent pressure on the Indonesian rupiah signals that the door to keeping rates untouched may be closing. Given the current inflation readings, BI can afford to extend policy support to the economy for a bit longer but we expect Warjiyo to change his tune should core inflation edge higher to the 4% top-end of the inflation target.

BI on hold as inflation remains manageable and within target

Dovish BI points to sustained weakness for IDR

The rupiah has been hit hard of late given the disparity in central bank disposition. The Fed hiked aggressively at its last meeting and signalled even more rate hikes at the next policy meeting, which is in direct contrast to the dovish stance taken by BI. To BI’s credit, inflation has remained relatively well-behaved and has yet to breach its inflation target.

With the current dynamic expected to remain in place, we expect IDR weakness to continue in the near term until BI finally decides to adjust monetary policy, possibly in the second half of the year. IDR weakness may be capped by the partial resumption of palm oil exports which could push the trade balance to a wider surplus but the currency will likely face pressure should the Fed follow through with aggressive tightening at its July meeting.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap