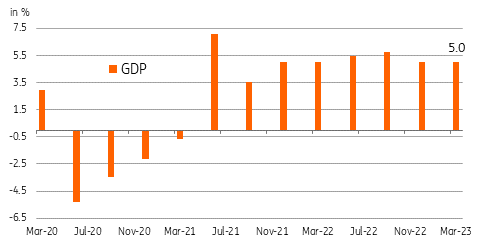

Indonesia: first quarter GDP steady despite high inflation and slowing global trade

Indonesia's economy managed to grow by 5% year-on-year in the first quarter of the year, fuelled by robust household spending

| 5.0% |

YoY GDP growth |

| As expected | |

First quarter GDP steady at 5%

Indonesia’s economy managed to expand by 5.0% year-on-year in the first quarter of 2023, steady from the previous quarter and in line with expectations. However, the economy slipped by 0.92% on a quarter-on-quarter basis, but this was slightly better than market expectations of a 1% fall.

Growth was broad-based with household spending, government expenditure and investment outlays all registering decent growth. The main driver for growth was household spending which managed to grow by 4.5%YoY and 0.25% more than the previous quarter.

Spending continued despite relatively elevated price pressures with both headline and core inflation peaking or close to their recent peak. Meanwhile, government spending grew by 4%YoY while investments gained 2.1% as capital formation slipped in response to aggressive tightening from the central bank.

Indonesia's economy motors along to post 5% YoY gain

Challenges up ahead, but growth prospects look relatively upbeat

Challenges to the growth outlook remain, with slowing global trade and brewing anxiety over financial market stability lingering. Softer global trade will likely cap expected gains on the trade front with export growth moderating from the outsized gains enjoyed in 2022.

Nonetheless, Indonesia's growth prospects look relatively upbeat as inflation edges closer to the central bank's 2-4% target. Easing price pressures could bolster household spending further while also allowing Bank Indonesia (BI) to eventually cut policy rates by the third quarter. A pivot for BI to rate cuts could reinvigorate bank lending and capital formation, which would give growth momentum another reason to accelerate. Given our outlook for slowing inflation, a stable currency and potential central bank easing, we may consider adjusting our full-year growth forecast of 4.6%YoY upwards.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap