India’s growth has gained some traction

The balance of economic risks remains tilted toward inflation

| 5.1% |

CPI inflation in January |

| As expected | |

Stubborn inflation

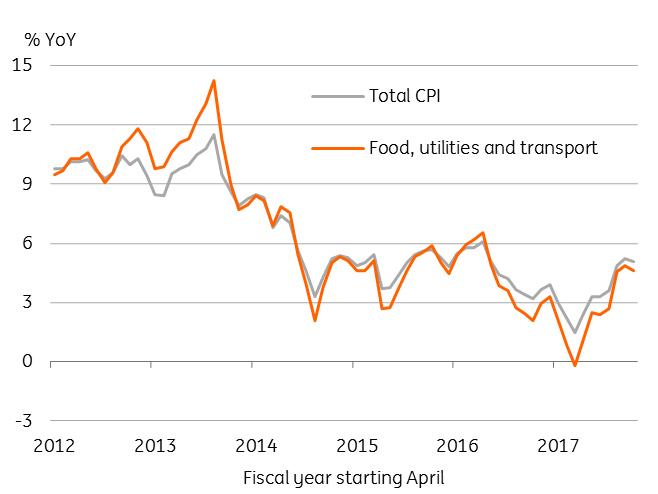

India’s consumer price inflation eased in line with the consensus to 5.1% year-on-year in January from 5.2% in the previous month. The seasonal month-on-month dip in food prices outweighed higher housing and transport prices while most other CPI components but for fuel posted month-on-month increases. The data is consistent with the Reserve Bank of India’s (RBI), the central bank, forecasts for 5.1% average inflation in the current quarter, up from a 4.6% average in the previous quarter.

January’s slight slowdown in inflation doesn’t offer much hope of a lasting relief from inflation. The RBI has warned of continued upward inflation pressures this year from persistent high food and oil-related components, hikes in housing allowance for civil servants, higher customs duty on several imported products, the fiscal overrun, and rising inflation expectations. On the RBI’s forecast, inflation could accelerate to as much as 5.6% in the first half of FY2018-19, followed by some moderation to 4.5-4.6% in the second half.

Upward inflation pressure

| 7.1% |

Industrial production growth in December |

| Better than expected | |

But some good news on growth

Also released yesterday, industrial production growth in December was better than expected at 7.1% YoY (consensus 6.0%, ING 5.6%), while the November reading was revised up to 8.8% from 8.4%. The 5.9% IP growth in the October-December quarter was up from 3.3% in the previous quarter, pointing to an acceleration of GDP growth over the same period. This data imparts some upside risk to our forecast of a modest pick-up in GDP growth to 6.5% in the October-January from 6.3% in the previous quarter (consensus 7.0%, data is due February 28).

Little policy leeway for the RBI

Growth has gained some traction but economic risks remains tilted toward inflation. With rising government borrowing constraining monetary tightening, our baseline for 2018 remains no change to RBI rate policy.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap

12 February 2018

Good MornING Asia - 13 February 2018 This bundle contains 3 Articles