India: Reserve Bank hikes and keeps tightening stance

The Reserve Bank of India (RBI) hiked a further 25bp, though rather than signalling “job done”, they have maintained their tightening bias

| 6.50% |

Repo rateUp 25bp |

| As expected | |

Headline inflation has moderated with negative momentum in November and December 2022, but the stickiness of core or underlying inflation is a matter of concern.

A more hawkish hike than anticipated

The prevailing view before this meeting was that the RBI would hike, but indicate that this was the last hike in this cycle as inflation was both below the RBI's policy rate (indicating positive real policy rates) and was also back within the RBI's 4+/-2% inflation target.

We had actually felt that the RBI might, as a result of falling inflation, decide to pause at this meeting - a minority view - and one which turned out to be wrong in the end.

But the consensus didn't get it all its own way either. Governor Shaktikanta Das said in his statement that the Monetary Policy Committee would "continue to maintain strong vigilance against inflation" a view he justified by noting persistently high core inflation which threatened to de-anchor inflation expectations.

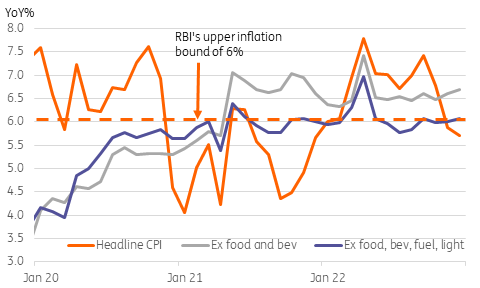

Indian headline and core rates of inflation relative to the RBI's target

So it's all down to the data now...

The chart above shows how the headline rate of Indian inflation has fallen, but that various core measures have remained persistently above the upper bound of the RBI's inflation target.

What is also fairly clear about these core measures of inflation, is that, unlike some western economies, the core inflation rates can deviate from headline inflation for considerable periods of time. So we can't take too much solace in the fact that headline inflation rates will likely continue to fall, as it could be a long time before core rates move down and into line with them.

Another factor we need to consider is the fact that India's economy continues to grow quite robustly. The RBI's forecast for growth in fiscal 2024 (the year ending March 2024) was 6.4%, only marginally down from the forecast of 7.0% for fiscal 2023. This will also be providing the RBI's Monetary Policy Committee with additional confidence that it has room to move rates up some more, without undue risk of triggering a recession. Indeed, Governor Das remarked that overall monetary policy remained accommodative, implying that there is further upside risk to rates if inflation is to be sufficiently tamed.

It seems reasonable to conclude that until these measures of inflation present less of a threat, by falling below 6% and remaining there for a couple of months, we can't rule out further rate hikes. So we will be amending our forecasts and adding a further 25bp taking peak policy rates to 6.75% after this latest increase and pushing back the timing of eventual rate cuts until next year.

That said, the decision wasn't unanimous. Two of the six-member MPC decided not to vote for the hike, and two also did not vote to keep the policy stance of withdrawing accommodation. Taking all of this together suggests that there is still a little more tightening to come, but though this latest hike did not represent the last in this cycle, we are now getting very close to the peak.

Financial markets took the rate decision and outlook in their stride. The INR did not react much at all, and 10Y government bonds only rose about 3bp to just under 7.34%.

Download

Download snap