India: Inflation creeps higher

Coming in just above the consensus estimate of 7.36%, India's inflation data for September provides the Reserve Bank (RBI) with some room to scale back on its recent tightening, and we maintain our forecast for only a 25bp rate hike in December

| 7.41 |

September CPIYoY% |

| As expected | |

It's always food

Saying that food prices were the main driver for the increase in the September inflation rate is true, but it is also not very interesting given the fact that food accounts for around 45% of the Indian CPI basket by weight. In any given month, food will almost certainly be either the main reason Indian inflation rose or the reason that it fell.

But within the food category, there were solid month-on-month gains in the biggest sub-group, cereals (2.0%, the second monthly increase of 2% or more), and the third biggest sub-group, vegetables also posted solid price increases (2.62%, also for the second consecutive month). And helping push the contribution of food to the total, some declines in food prices in August (meat and fish, and eggs) swung back to positive price changes in September, which is if anything, more supportive for inflation acceleration as solid sequential monthly price gains.

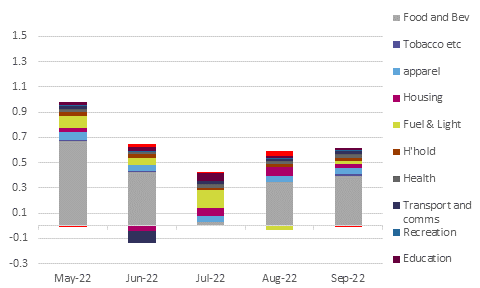

There were modest contributions to the overall total from all the other sub-components of the main index, with the exception of personal care and effects, and the contribution to the overall total from housing more than halved from the previous month, though didn't make much of an impression on the CPI total.

Contributions to MoM% inflation growth

Nothing too alarming here

What this inflation release did not do, was suggest that Indian inflation is running out of control. The last four months of inflation increase on a sequential monthly basis, have been fairly steady at around 0.5-0.6%. Even if the price level continued to rise at this pace, year-on-year inflation would slowly drift down to around 6%, and there are good reasons to believe it will slow more than that. In fact, as soon as next month, inflation should fall back into the mid-range of 6%, and besides a brief uptick over the December-January period – entirely due to base effects, we see inflation easing back to around 5.5% by March next year.

Rates, and inflation forecasts

RBI isn't done yet, but nearly

What this probably means for monetary policy is this:

- Policy rates have probably not peaked yet, but they can be raised at a slower pace, and we look for only a 25bp hike at the next policy-setting meeting in December. That will take the repo rate to 6.15%, and we think that at that point, the RBI may be done.

- It also means that there is the possibility of some reduction in rates as soon as the second quarter of 2023, as headline inflation drops below the nominal policy rate and returns rates back to "real" positive values. There is certainly scope for the RBI to trim some of this year's tightening in 2023 and begin to re-focus on growth.

That combination of a return to positive real policy rates and a more supportive setting for growth is a better environment for the INR. And although the near-term outlook for the currency remains difficult, with the Fed still hiking aggressively, before the year-end, that backdrop might be looking a lot more benign.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap