Hungary: Weak December signals further weakness in retail

The retail sector closed 2018 with its worst performance in a year, which could be a warning sign for 2019

| 4.1% |

Retail sales (YoY)Consensus (5.1%) / Previous (5.2%) |

| Worse than expected | |

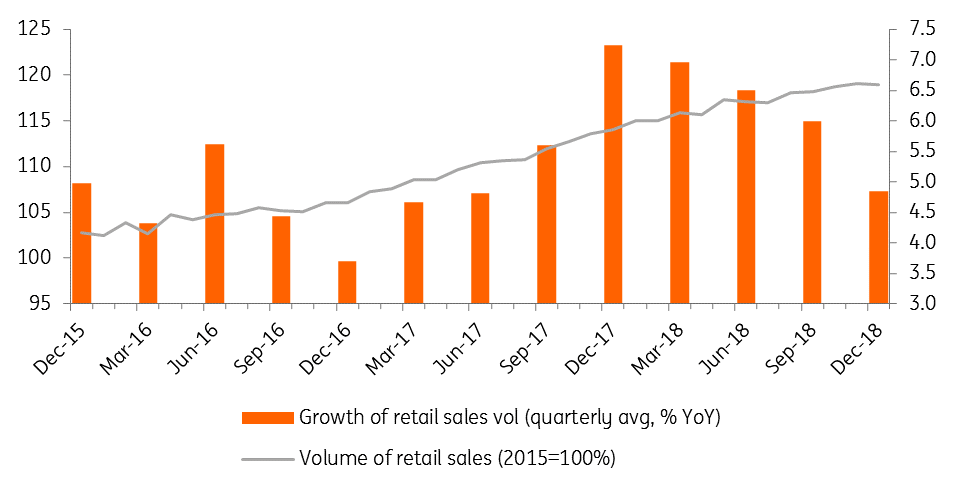

We envisaged a rebound in retail sales in December after weakness in November, but working days adjusted retail sales increased by just 4.1% year-on-year, a clear disappointment. Still, this was a decent growth rate and helped sales to climb 6% in 2018 as a whole. Last year’s performance in the retail sector was a touch better than the previous year’s, but the second half of 2018 was significantly weaker and the trend like deceleration translated into the worst growth rate for the year in December. The winter holiday season in 2017 was undoubtedly stronger, so the high base did not help either.

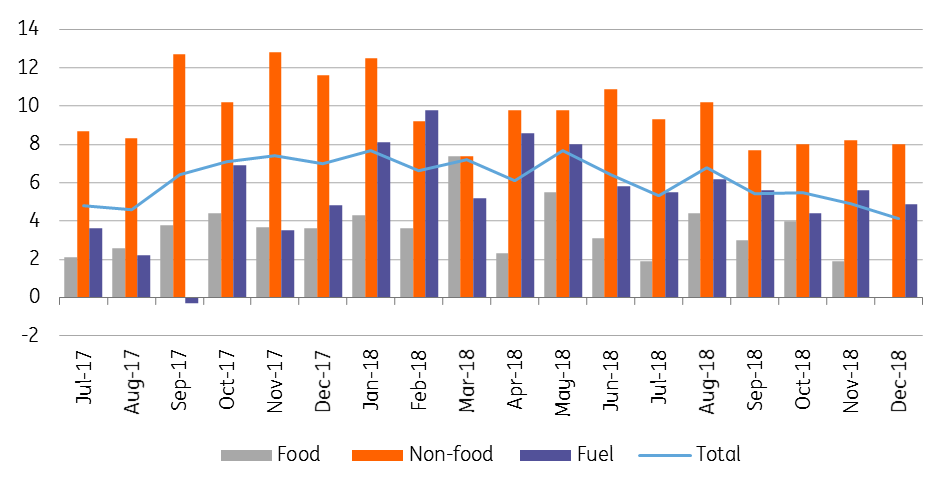

Breakdown of retail sales (% YoY, wda)

Turnover in food shops, which stagnated on a yearly basis, was the main factor behind the weaker-than-expected performance overall. However, non-food retailers and fuel shops also closed 2018 with one of the weakest year-on-year growth rates of the year, while still showing decent results. Weakness is present all across the sector.

Retail sales volume

Regarding 2019, the loss of economic momentum in the retail sector is quite obvious. Continued wage growth should continue to support the sector, but we think it unlikely that the strong performance continues in 2019.

Services rather than retail might be the beneficiary of continued wage growth

If the sector maintains its 4Q growth rate, we see a 4% increase, on average, in the retail sector this year. The 4Q18 weakness will definitely show up in the GDP data, suggesting a deceleration in consumption growth, which will carry over into 2019. However, as the real disposable income of households continues to rise, we see a shift from consuming goods to buying more services, holding back the retail sector’s potential in the future.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap