Hungary: The wages vs consumption puzzle continues

The stronger-than-expected wage growth remains puzzling as based on the labour market data, the retail sector should not be in a downward spiral

Here we go again with yet another upside surprise when it comes to labour market statistics. Yesterday’s unemployment rate showed an unexpected improvement and after the January upside surprise, wage growth came in higher in February. Wage growth didn't just surprise on the upside, it accelerated compared to January despite the significantly lower minimum wage increase which kicked in in February. The 9.8% year-on-year growth of average gross (and net) wages in February are remarkably sound amidst a crisis.

The strong earnings figure remains puzzling, although technicals are playing a role here. Based on the institutional employment statistics, the number of employed increased around 0.7% month-on-month. However, this improvement came from significantly higher demand for labour in high-earning sectors (IT, finance etc.), while low-earning sectors were still suffering from the closure of in-person activities. So, this composition effect is impacting the average wage level in a positive manner. However, this in itself hardly explains the near double-digit wage growth.

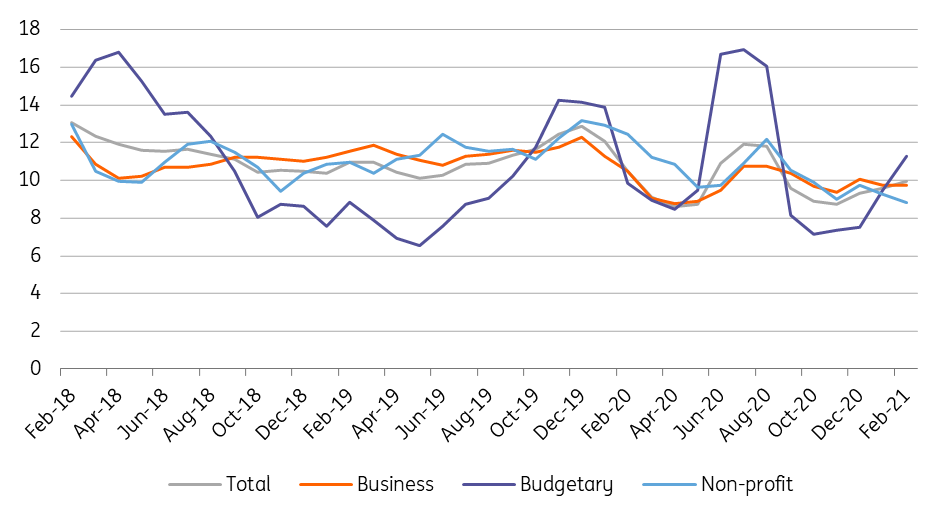

Wage dynamics (3-month moving average, % YoY)

What could explain this is the ongoing public sector wage settlement. Due to planned wage rises in certain government segments – including pay rises for doctors, judges and prosecutors, and employees of nurseries – the growth of average wages in the budgetary sector (13.5% YoY) exceeded that of the national economy in February.

In addition, there are green shoots in the private sector too: wage growth in the private sector came in at 8.9% YoY on average, showing an acceleration compared to the previous month. This is mainly due to the stronger salary increase in agriculture, mining, construction, retail, finance and real estate sectors.

Trend of wages and retail sales growth (% YoY)

Looking forward, we still expect a softening in the average wage growth in the coming months. This should come from the private sector as the positive impact of public wage settlement will be with us for the whole year. Moreover, we see the reopening as massively increasing the number of low-earners (in in-person activities) in the labour market, translating into a negative composition effect. In 2021, we expect official wage growth of 7% on average.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap