Hungary: Tax adjusted core CPI jumps above the target

Today’s strong inflation readings mean that the National Bank of Hungary has just reached the point of no return, with all inflation indicators above target

| 3.2% |

Core CPI ex-tax (YoY)Previous (3.0%) |

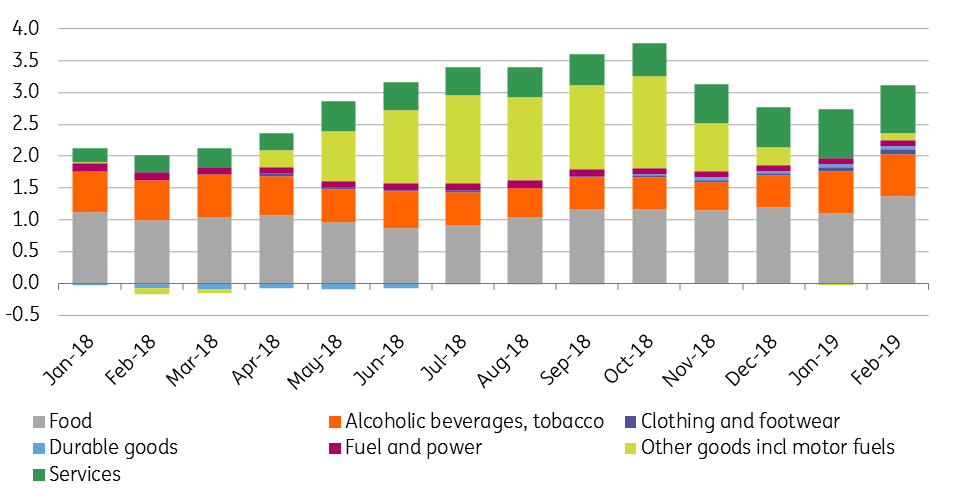

Headline inflation came in at 3.1% YoY in February, accelerating by 0.4ppt from the January reading. The above-consensus reading was fuelled by price changes in goods. First of all, the 5.2% price increase in food products added 1.4ppt to the headline reading, 0.3ppt higher than in the previous month. The main catalysts for this were fruit and vegetables, along with processed food products, with much of the latter also pushed higher by tax changes affecting unhealthy products. Prices of alcoholic beverages and tobacco were up by 7%, also influenced by tax and excise duty changes. Fuel prices increased almost 1% month-on-month and, due to the low base, also pushed up the headline inflation reading, by 0.1ppt. Inflation in durables and services has remained relatively stable, causing a mild downward surprise.

The composition of headline inflation (ppt)

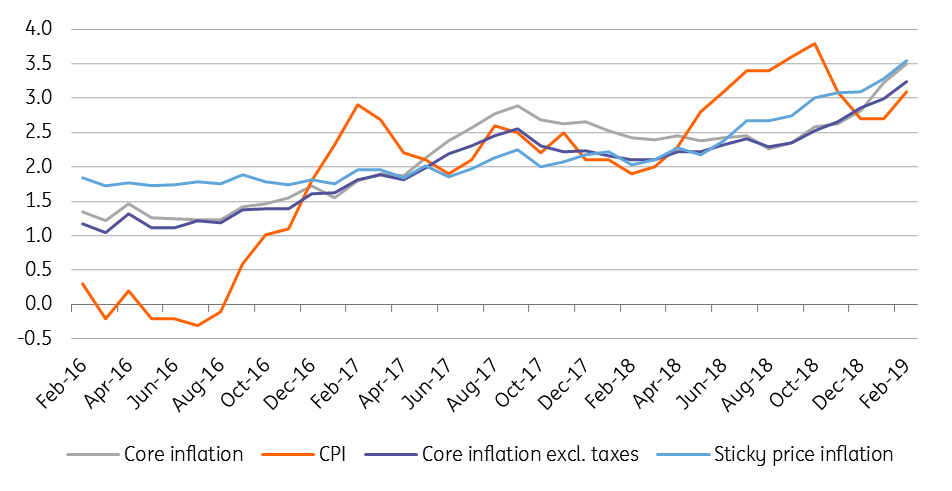

Against this backdrop, core inflation should have been even higher, but still accelerated by 0.3ppt to 3.5% YoY in February, reaching a level not seen since December 2013. As the main reason behind the significant price increase is tax changes (+0.26ppt), it hardly comes as a surprise that NBH-calculated core CPI excluding indirect taxes came in at 3.244% YoY. The 0.26ppt increase vs January also means, that this linchpin indicator for monetary policy has risen clearly above the inflation target. Sticky price inflation accelerated to 3.6% YoY, a price increase not seen since October 2009.

Headline and core inflation measures (% YoY)

With today’s release, all of the important inflation indicators are clearly above target and the National Bank of Hungary has just reached the point of no return. In the context of a dovish ECB and a gloomy outlook, if the NBH wants to maintain credibility then it needs to start the monetary policy normalisation at its next rate setting meeting on 26 March. We expect the NBH to decrease the outstanding amount of FX swaps in 2Q19, combining this with a hike in the overnight deposit rate.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap