Much-awaited Hungarian wage data arrives

The surprisingly strong Hungarian wage growth in January is somewhat deceptive and we see a marked softening ahead. In our view, this discrepancy is partly coming from precautionary savings and partly from technical factors which are moving wages higher

The January surprise

After an upside wage growth surprise in December, we were almost sure, that a slow down is coming in January.

However, the 9.5% YoY growth of average gross (and net) wages in January is pretty remarkable given the pandemic.

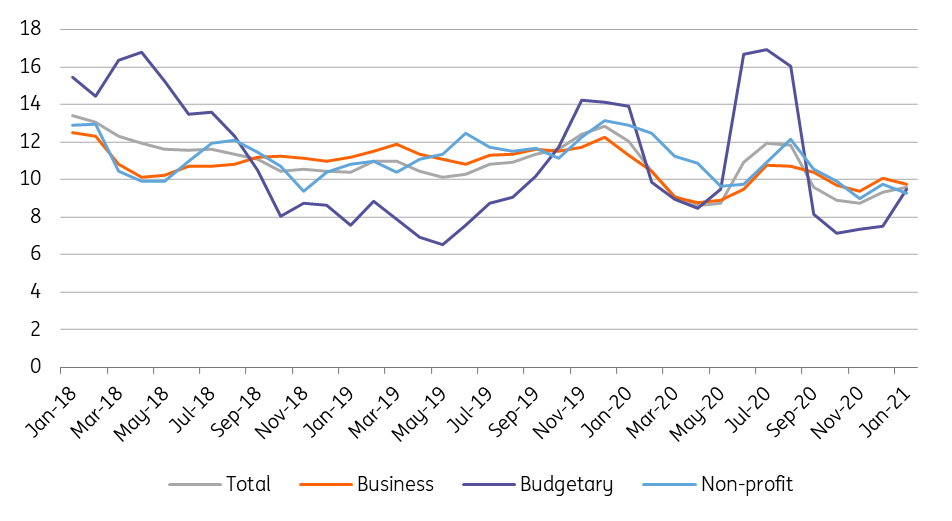

Wage dynamics (3-month moving average, % YoY)

Three factors behind wage growth

- Technicals: Employment is increasing in those sectors where the sectoral wage is higher than the national average, but there is a marked decrease in employment in in-person activities where sectoral salaries are well below the national average. This composition effect has pushed average wages higher. On top of that, wage data only contains full-time workers, and during the second wave, we saw a continuous shift from full-time to part-time, mainly in low-earning activities. This again supports the average wage growth via the composition effect.

- Public sector wage settlement: Due to planned wage raises in certain government departments – including the pay raise of doctors, judges and prosecutors, and nursery employees – the growth of average wages in the budgetary sector (13.3% YoY) exceeded that of the national economy in January.

- Private sector green shoots: Wage growth in the private sector came in at 8.5% YoY on average, but there are some sectors where Covid-19 brought more opportunities than damage. Water supply and waste management, logistics, real estate activities & professional, scientific and technical activities are the main areas where the wage growth was higher than the private sector average.

Even though wage growth looks sound, if we compare this wage statistics to the retail sector performance in January, this increased wage outflow is not reflected in the consumption. The retail sector’s turnover decreased by 1.8% yearly in the first month of 2021. In our view, this discrepancy is partly coming from precautionary savings and partly from technical factors which are moving wages higher.

Decoupling between the retail sales (% YoY) and wages (% YoY) trends

Looking forward, as minimum wages increased by only 4% YoY and this shows up in February data, we expect the average wages to soften, especially in the second half of the year as the reopening of the economy will massively increase the number of low-earners (in-person activities) in the labour market.

By the end of the year, we forecast 4.5-5% wage growth only.

Full-circle data and median wages

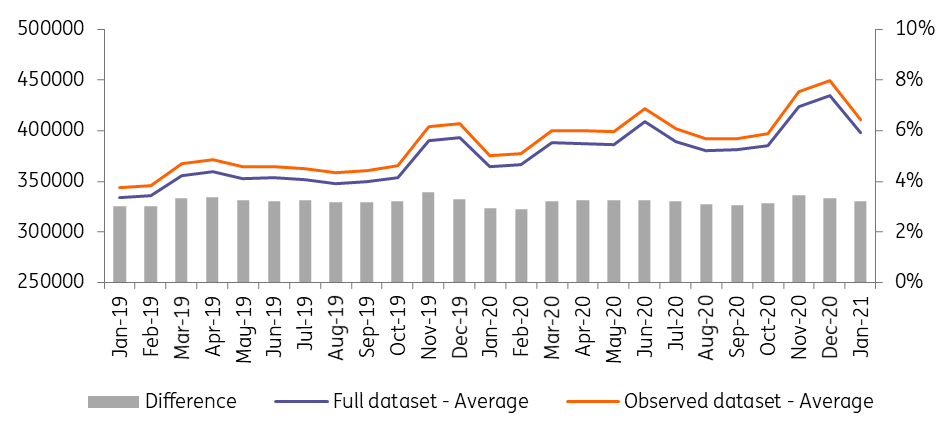

The Hungarian Central Statistical Office released a new set of wage data based on a wider range of data collection. The well-known and used data set, contains wage statistics from observed employers only, which means this data was missing the labour data coming from companies employing less than five people and less relevant NGOs.

In contrast, the new so-called full-circle data contains all businesses, budgetary institutions and non-profit organisations. As we guessed, this will better account for people working in small-enterprises earning less than the average. The roughly 3% difference between the observed and full-circle wages data validates that.

The difference (%) between the observed- and full-circle wages (HUF)

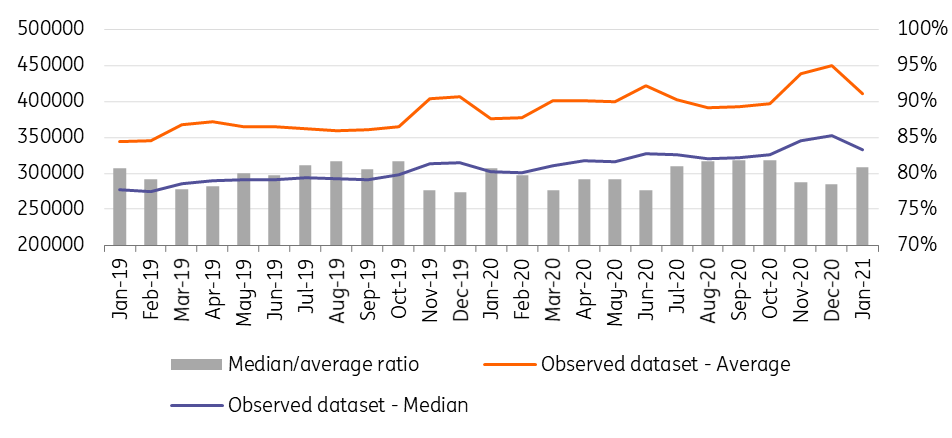

Besides this, the statistical office also released a long-awaited time series: the median wages in Hungary.

According to some early reports, the median-average wage ratio was 75% in 2010, while the latest official data shows it is now around 80%. The improvement was mainly fuelled by the remarkable minimum wage increases since 2016.

Median and average gross wages (HUF)