Hungary: Retail sales to slow

Retail sales rose slightly in October but as household spending is likely past its peak, the sector’s performance could soon moderate

| 5.7% |

Retail sales (YoY, wda)Consensus 5.8% / Previous 5.4% |

| Worse than expected | |

Retail sales adjusted for working days rose by 5.7% year-on-year in October. The latest data was roughly in line with the market's expectations. While the pace of growth picked up from the previous month, it's still below the average of 2018, though it roughly matched the 3Q18 performance.

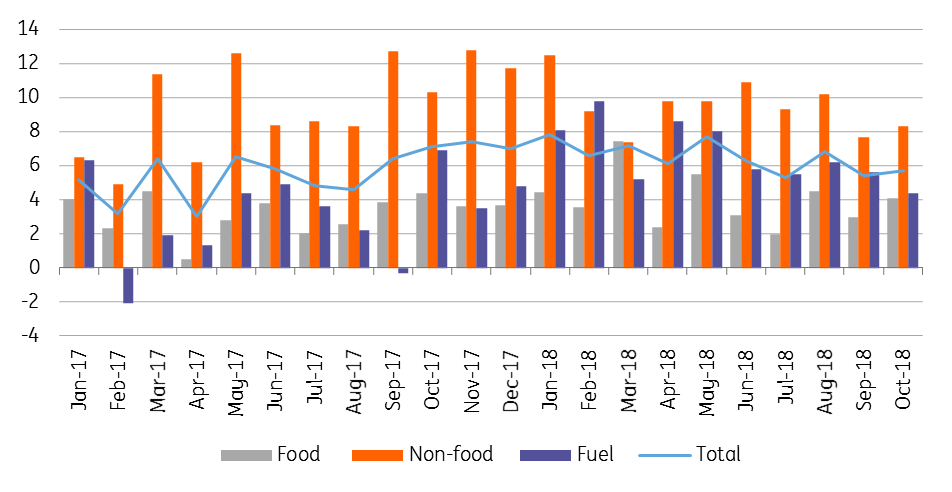

Volume of retail sales

We don't see any surprises in the structure of the expansion. The performance of both food and non-food shops fits the trend we have seen in 2018 so far. However, when it comes to fuel consumption, the 4.4% year-on-year growth rate is the worst performance this year. Still, it is pretty obvious that the significant increase in oil prices-which also fed through to local fuel prices- restrained sales of fuel.

Breakdown of retail sales (% YoY, wda)

Looking forward, we expect the record tight labour market to further support household spending. However, as real wage growth has been slowing lately, and the base is already high, we see retail sales decelerating gradually in the coming months, with close to 6% YoY growth in 2018 as a whole.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap