Hungary: Inflation slows on temporary factors

Both headline and core CPI decelerated further in February. We expect inflation to bottom out at these levels with a slow, gradual pick-up during the rest of the year

| 1.9% |

Headline inflation (YoY)Consensus (2.0%) / Previous (2.1%) |

| Lower than expected | |

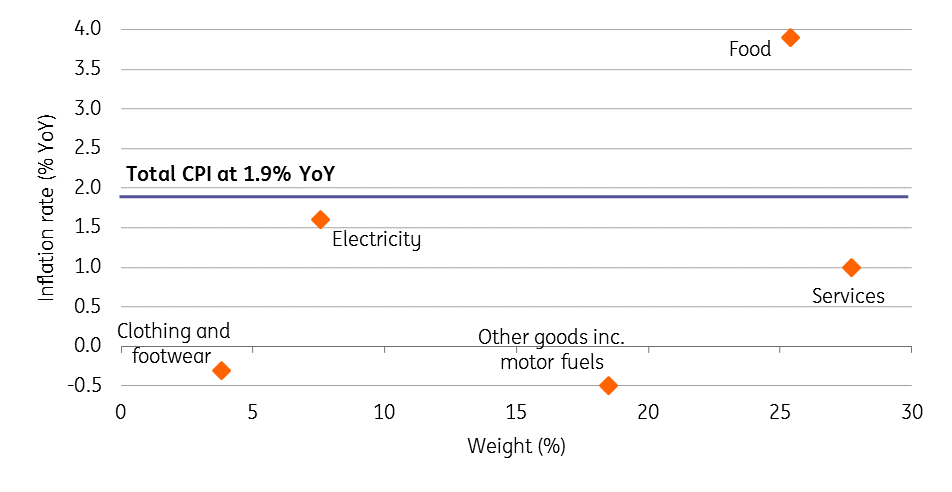

Headline CPI came in at 1.9% year-on-year, down from both the previous data and the market consensus. Despite the minor surprise, the downward move was expected and so we hardly see this as a game changer. Core inflation also slowed 0.1ppt to 2.4% YoY, moving away from the 3% inflation target.

Headline and core inflation measures (% YoY) heading south

The slowdown was quite widespread. Annual inflation moderated in food and clothing mainly due to high base effects and seasonal factors. We saw falling prices in clothing as well as in durables. Fuel prices also dragged down the headline CPI due to base effects. One significant area in the consumer basket which showed strengthening prices was in services: inflation increased by 0.2ppt to 1.0% YoY.

The highest – above average – inflation rate was measured in food, and beverages and tobacco products, with higher excise duties driving up prices in the latter product group.

CPI by main groups in Feb-18

Looking forward

We expect inflation to bottom out in February, with a slow but gradual increase during the year, reaching 2.8% YoY by end-2018. On average, we expect inflation to come in at 2.6% in 2018. The risks lie to the downside, however, and we hardly expect any change in monetary policy.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap