Hungary: Inflation sinks on fuel prices

Change in inflation from February to March was shaped by the oil market shock, stockpiling for food due to the coronavirus outbreak and the record weak HUF also played a role

| 3.9% |

Headline CPI (YoY)Consensus 3.6% / Previous 4.4% |

| Higher than expected | |

March headline inflation came in at 3.9% year-on-year, showing a 0.5ppt deceleration compared to February. A lot of different factors were at play - some were pro-inflationary, while others helped the indicator to retreat.

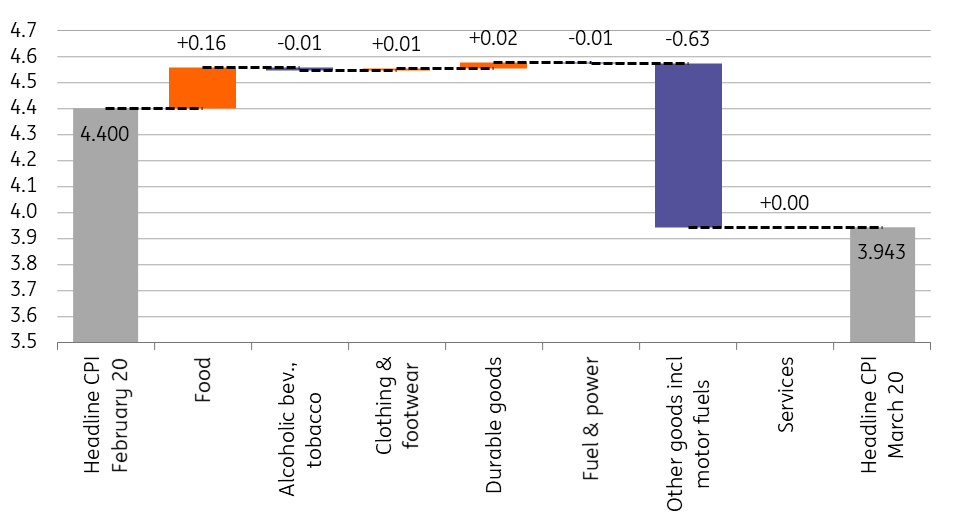

Main drivers of the change in the headline CPI (%)

- The Hungarian central statistical office measured only a 5.3% MoM drop in fuel prices in March. Due to methodological reason (data collection ends on the 20th day of every month), the majority of the price drop will be carried over in the April reading, contributing to the higher-than-consensus headline reading;

- Food inflation came in at 7.6% year-on-year on the back of food stockpiling. So, as we expected, in the short term, the coronavirus will be pro-inflationary;

- Tobacco products showed a 1.2% monthly price increase causing an upside surprise which might be related to tax changes and HUF weakness;

- Speaking of the forint, durable goods inflation strengthened by 0.2% on a monthly basis, as prices of import-heavy products rose (vehicles, jewels, white goods);

- Price change in services remains unchanged for the third month in a row at 0.5% MoM. The lack of demand due to the lockdown has not yet affected prices.

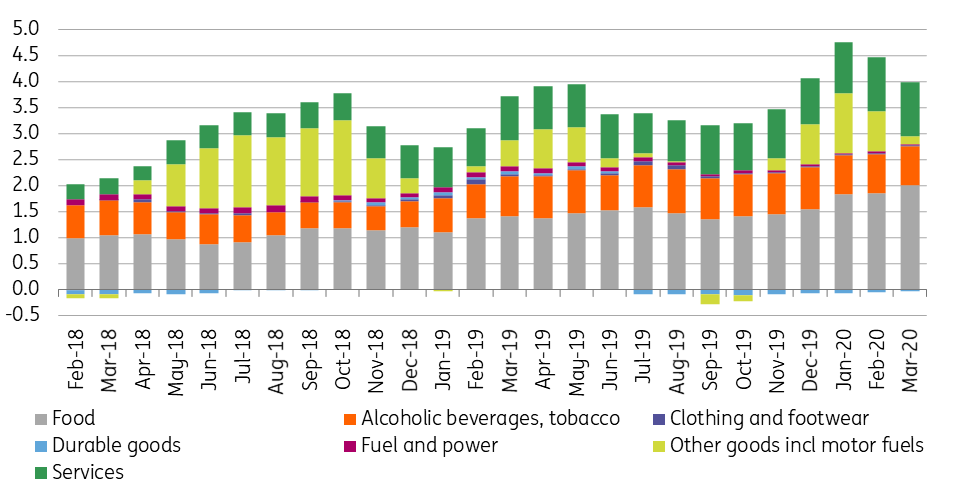

The composition of headline inflation (ppt)

The deceleration in the headline indicator was stemming from technical factors and non-core items.

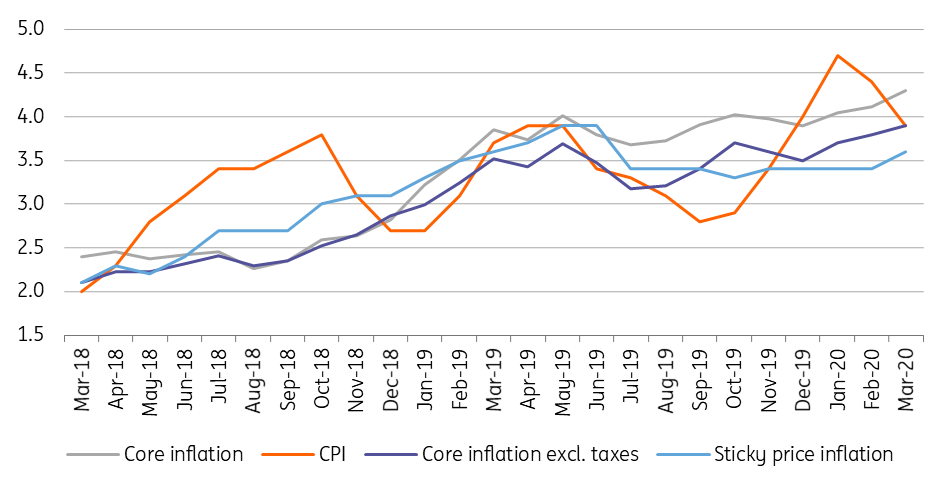

In the meantime, the underlying inflationary processes accelerated on durables, processed food, tobacco, translating into a 0.2ppt higher core inflation (4.3% YoY). If we adjust this reading for tax changes, core inflation excluding indirect taxes show only a 0.1ppt acceleration to 3.9% year-on-year.

Against this backdrop, half of the increase in core inflation stems comes from tax changes.

Headline and core inflation measures (% YoY)

Looking ahead, we see headline inflation dropping further due to oil prices and the base effect is also looking favourable.

On the other hand, the short-term inflationary impact of a weak HUF and a run for non-perishable items might keep core inflation elevated. However, by the end of the year, we see both readings hovering around the central bank's inflation target at 3%.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap