Hungary: Inflation uptick on the back of fuel prices

Headline CPI increased in line with expectations in April while core inflation remained roughly flat. Don't expect any reaction by the central bank as they are busy fighting falling liquidity

| 2.3% |

Inflation (YoY)Consensus (2.3%) / Previous (2.0%) |

| As expected | |

Headline inflation came in line with expectations at 2.3% year on year in April, causing no surprise at all.

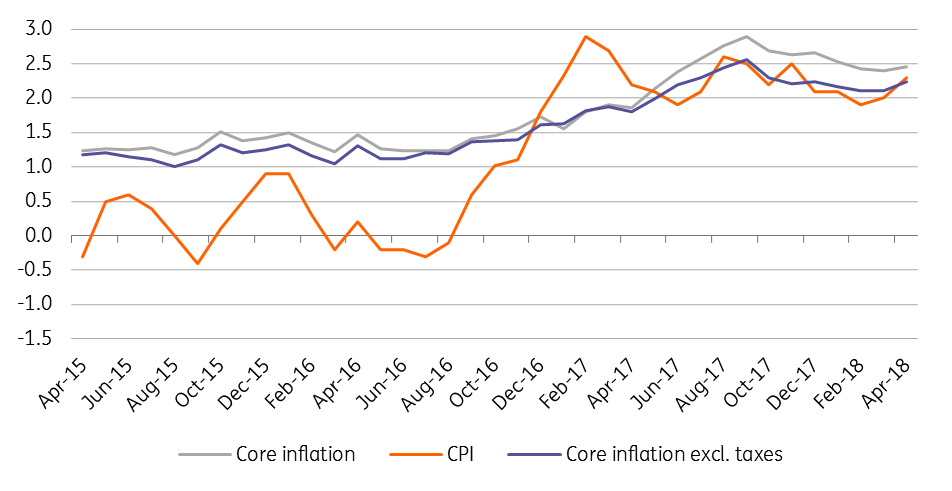

The 0.3ppt acceleration stems mainly from the global oil price increase spilling over into fuel prices. Core inflation remained unchanged at 2.4% YoY, in line with the central bank’s expectation. We hardly see any change in monetary policy on the recent inflation release. Anyway, the hands of the National Bank of Hungary are now full, fighting against falling liquidity indirectly due to the government short-term financing needs.

Headline and core inflation measures (% YoY)

No sign of wage push inflation

The upward movement of the CPI was driven mainly by the fuel price increase. Meanwhile, the inflation in food also accelerated somewhat. On the latter, eggs, pasta products, butter and dairy products are leading the price increase. The highest inflation rate still belongs to alcoholic beverages and tobacco products due to taxation changes. We have seen dropping prices in durables for the sixth month in a row. CPI in services decreased by 0.1ppt to 1% YoY, thus no sign of wage-push inflation.

CPI by main groups in April 2018

Orange marked signs point to acceleration while greys sign signify a slowdown in inflation compared to the previous month

Expect inflation to accelerate further

Looking forward, we see mildly accelerating inflation in the coming months, mainly on the back of fuel prices.

We maintain our inflation forecast of 2.5% YoY in 2018 as a whole.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap