Hungary: Inflation accelerates but misses forecast

Headline CPI increased to 2.5% year-on-year but as all indicators are lower than the 3% target, we don’t see the central bank changing its monetary stance anytime soon

| 2.5% |

Headline inflation (YoY)Consensus (2.6%) / Previous (2.2%) |

| Worse than expected | |

Headline CPI climbed to 2.5% year-on-year in November, roughly matching the expectations (consensus: 2.6% YoY) It would be really hard to interpret this as a surprise, as the forecasts were in an unusually tight range. Core inflation came in flat at 2.7% YoY in November.

All of the indicators are lower than the 3% target

Bottom line is, all of the indicators are lower than the 3% target and both we and the NBH sees the recent uptick in inflation driven by temporary factors, thus we don’t expect any change in monetary stance triggered by recent data.

Headline and core inflation measures

The detailed data show that tobacco prices increased by 8.8 % YoY due to the previous increase of excise duty due to the obligatory tax harmonisation with the EU. Prices of food posted an above average 3.1% YoY increase on the back of the price increase of processed food (mainly milk and dairy products). Prices of coffee jumped by 7% YoY and meals at restaurants also increased by 4% YoY. Services inflation has remained at a below-average level of 1.8% YoY for the third month in a row. As regards fuel, prices jumped by 2.5% MoM, and 5.2% YoY, showing a significant base effect and the recent oil price increase.

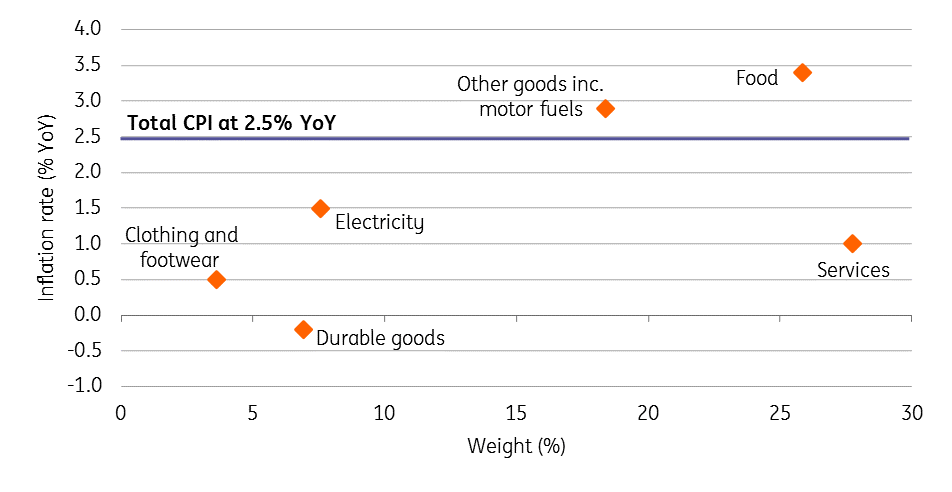

CPI by main groups in November

Looking forward, inflation might decelerate further in October on the back of base effect stemming from the energy price changes in 2016. We keep our call of 2.4% YoY inflation on average in 2017.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap