Hungary: Industry’s output remains close to last year’s level

Déjà vu. Like we saw in August, the retail sector let us down while industry surprised on the upside in September. The volume of output remains close to last year’s level thanks mainly to car manufacturing and electronics

| -1.0% |

Industrial production (YoY, wda)Consensus -3.2% / Previous -0.2% |

| Better than expected | |

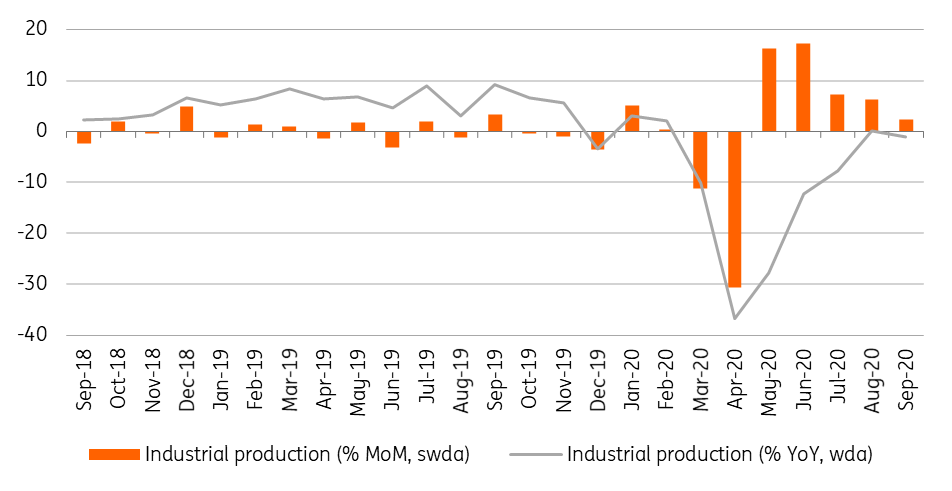

Despite the global uncertainty, it seems that industry is in very good shape. Unlike the retail sector, industrial production has surprised on the upside for two months in a row. On a monthly basis, industrial production rose by 2.3%. With this performance, output volume based on calendar-adjusted data is only down by 1.0% year-on-year in September. This doesn’t mean that we are out of the woods yet, but it offers a silver lining.

Performance of Hungarian industry

The main sectors fared well, with car manufacturing, electronics and food industries - the three main sectors in Hungary - showing significant growth. But all the other subsectors posted a drop in production volume. In our view, if supply chain disruptions can be avoided in the most important sectors (mainly car and electronics), industry and thus export activity will be the main driver of growth. After depressing retail sales data, industry could become the economy's saviour, helping to avert a double dip in the fourth quarter, as in Germany.

The 31% quarter-on-quarter growth in industry in 3Q20 supports our call for a record high, double-digit QoQ GDP growth rate in the July-September period. Although this is just a mechanical rebound after the spring stoppage in industry resulted in an extremely low base.

Industrial output volume and quarterly performance

Looking forward, there are some concerns. The latest order levels are encouraging so until the end of the year, industry will be fine, supporting the recovery. But with the second wave of Covid hitting the global economy, supply chain disruptions could become more frequent again, derailing the local recovery. On top of that, the second wave will impact external demand too, affecting industry in 2021. Long story short: the situation remains fragile.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap