Hungary: Industry remains resilient

Amid mounting issues with a lack of equipment, materials and labour, industry was able to maintain a high level of production in June

| -0.3% |

Industrial production (MoM, swda)ING forecast 1.5% / Previous 3.3% |

We have mixed feelings regarding the incoming industrial production data. It's an exaggeration to say that production was remarkable in June. The 0.3% month-on-month drop is far from strong but it was better than the market consensus (though lower than our forecast). And if we look at today’s German industrial data release, we see a much more drastic drop in production there. In the meantime, we know that supply chains continue to show severe disruption, so overall, Hungarian industry proved to be quite resilient in June. Due to last year’s extremely low base, annual growth came in at 22%, based on the unadjusted time series.

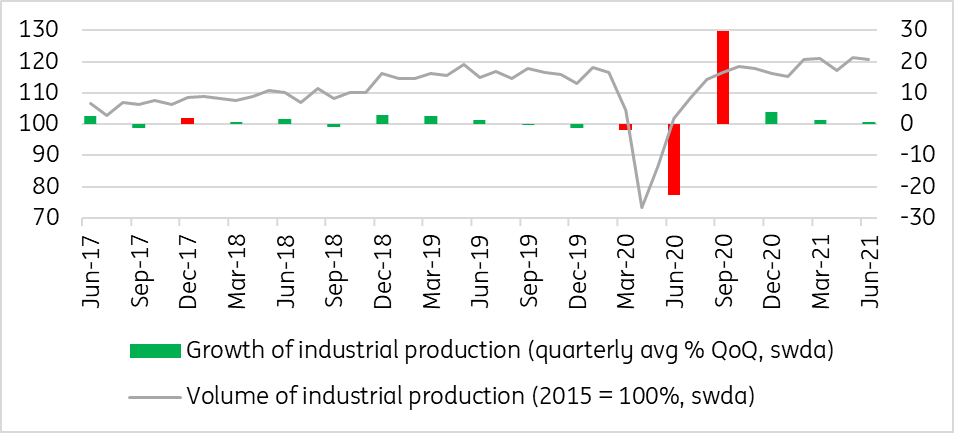

Performance of Hungarian industry

Based on the preliminary data release, an expansion was observed in all sub-sectors, although some sectors showed a significant slowdown compared to the performance of the previous month. Unsurprisingly, the automotive industry has slowed down the most, as this sector is suffering more from shortages of inputs and the fragmentation of supply chains.

For the past three months on average, Hungarian industry improved (in terms of the volume of production) compared to the previous quarter, by roughly 0.6% based on seasonally-adjusted data. Given the retail sales data published earlier this week, we can say that the Hungarian economy performed quite well in the second quarter of 2021. According to our forecast, it could even repeat the 2% quarter-on-quarter growth seen in 1Q21.

Production level and quarterly performance of industry

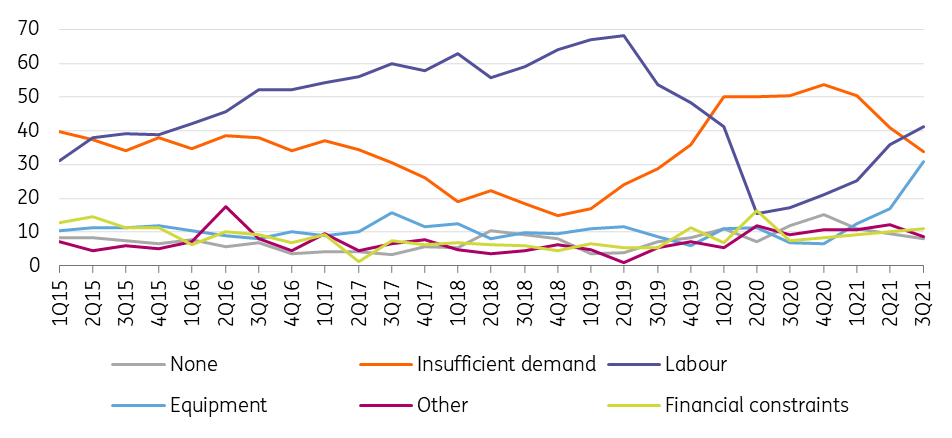

As for the near-term, until supply chain disruptions have been resolved, we see sustained but moderated growth. The main reason behind the expected continuous improvement is the new production capacity in battery factories. And due to the dynamic expansion in global demand, the level of orders may continue to grow, though impeded production capacity means we can expect longer delivery times. Issues with capacity utilisation are more and more visible, as 41% of companies are now complaining about an insufficient number of workers and 31% see equipment and material shortages as factors limiting production.

Factors limiting industrial production - Hungary

All of this means rising input and labour costs, which may further strengthen producer price inflation in the months ahead. As producers are in a better bargaining position amid expanding demand and scarce supply, we see this as becoming more of an issue from a consumer price point of view too, further strengthening the already high inflation pressures.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap