Hungary: Industry remains a stronghold

Industrial production yet again surprised on the upside. The sector is proving to be the stronghold of the economy in the second wave of Covid-19

| 2.7% |

Industrial production (year-on-year, working days adjusted)ING forecast 1.0% / Previous -1.0% |

| Better than expected | |

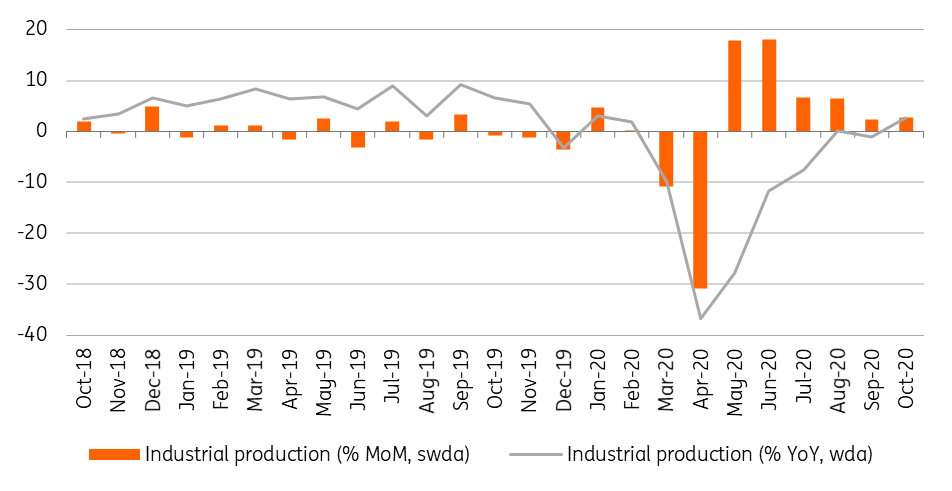

Industry has remained in very good shape despite the second wave of Covid-19. Unlike the retail sector, industrial production has surprised on the upside for three months in a row. On a monthly basis, industrial production rose by 2.8%, an even stronger performance than a month ago. With this, the volume of output increased by 0.6% year-on-year. However, due to a few holidays, the calendar effect is very strong. Adjusting for that we get a 2.7% YoY performance.

Performance of Hungarian industry

As usual, in order to see industry performing really well, the two most important sectors need to thrive. Although the recent data release didn’t contain any detailed data, the Statistical Office highlighted in its commentary that car manufacturing and electronics were able to increase production, while other industries posted a drop in production volumes.

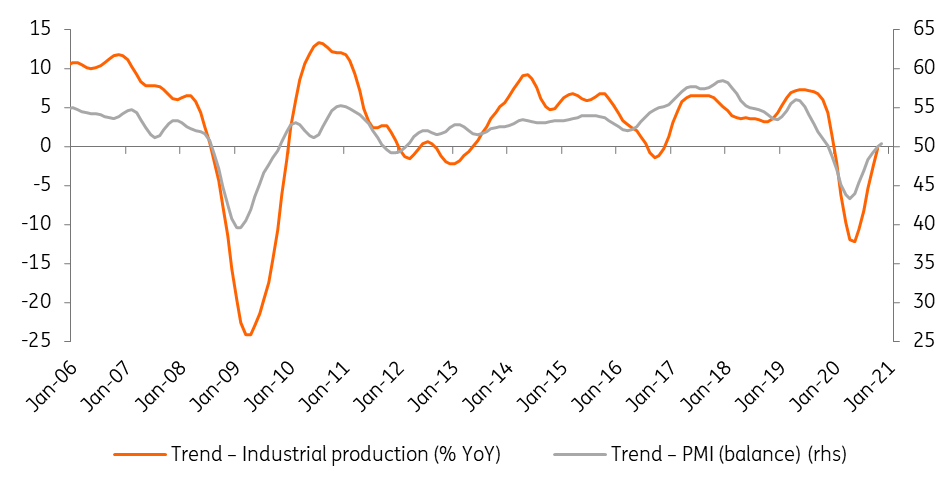

Manufacturing PMI and industrial production trends

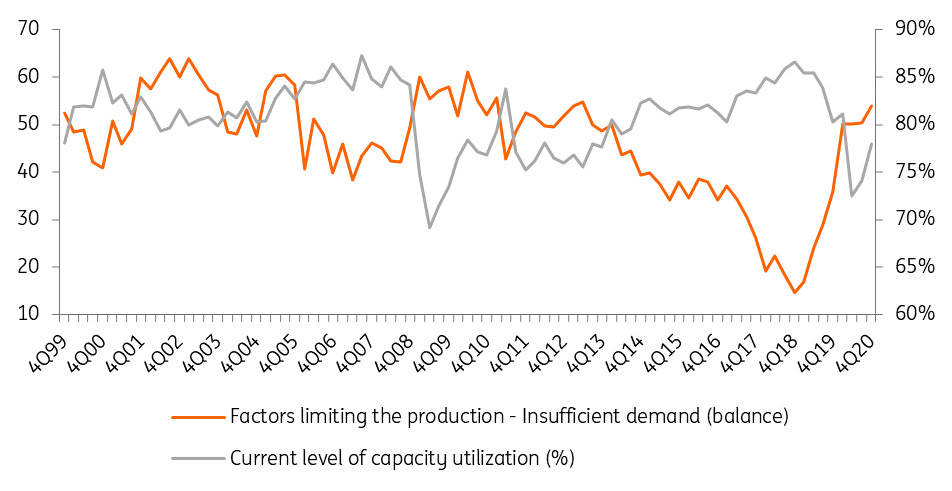

In our view, if supply chain disruptions can be avoided in the most important sectors (mainly car and electronics) amid the second wave, industry and thus export activity should drive growth. The level of orders, as well as the PMI, paints an encouraging picture at least in the short run. There is still enough room for improvement as the latest data on capacity utilisation sits just below 80%, significantly lagging the pre-crisis peak. This could explain why companies are saying that insufficient demand is becoming an increasingly important factor limiting their production.

Capacity utilisation and factors limiting production

The expected positive impact on export activity due to the strong industrial performance will likely be countered by the really weak domestic demand (consumption and investment) in the fourth quarter. Against this backdrop, we maintain our call for a 2.5% quarter-on-quarter drop in GDP in the fourth quarter of 2020.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap