Hungary: Industry performs well

Industry caused a positive surprise yet again. This, combined with the strong 3Q GDP and recent retail sector readings, paints a positive picture.

| 7.6% |

Industrial production (YoY)Consensus: 6.7% / Previous: 8.1% |

| Better than expected | |

Industrial production surprised again on the upside, posting a 7.6% year-on-year growth in October, the second best performance in 2017 so far. This is the second reading after yesterday’s retail sector data, showing encouraging signs of further strengthening in economic activity in 4Q17.

The HCSO hasn’t shared any details on the data and without any commentary we can only guess at the main drivers behind the growth. Based on the data in previous months, we surmise that the growth was rather widespread and not just driven by the automotive industry. However, such a strong performance is more-or-less impossible without at least an average to good growth in the car industry. On the other hand, we see electronics, food and chemicals contributing significantly to production growth in October.

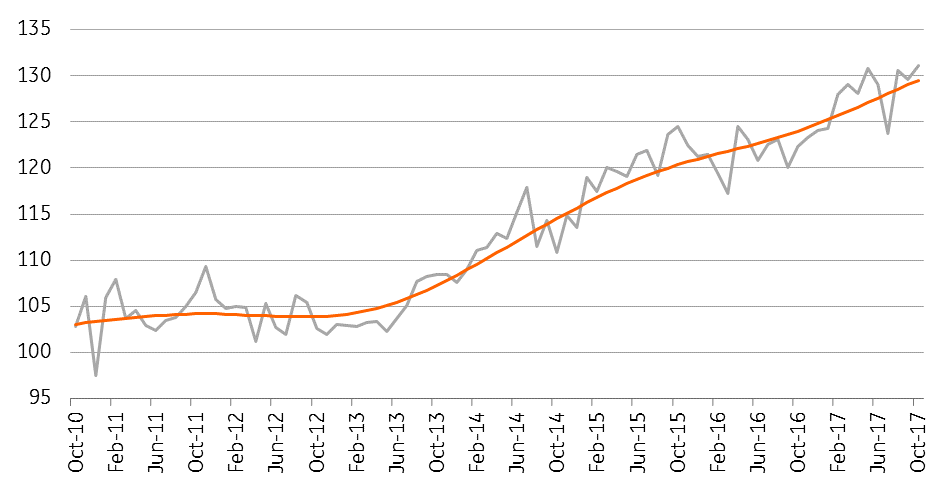

Industrial output heading upwards

(2010=100%, swda)

When it comes to the overall economic activity, the picture is rosy.

As regards the short-term outlook, we see further strengthening of industrial production - based on the latest soft indicators such as Hungarian and German PMI data or the confidence indicators in the sector. Moreover, the stock of orders is higher compared to the same period of last year, adding to the story of further good performance. Hungarian industrial output could reach a 6% YoY increase on average in 2017. However, the main question remains the labour shortage and its possible negative effect on capacity utilisation going into 2018.

Both industry and the retail sector posted strong growth in October and the recent 0.3ppt upward revision in 3Q17 GDP growth also shows positive underlying momentum. Against this backdrop, we see further strengthening of economic activity in 4Q17.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap