Hungary: Industry goes from bad to worse

We've grown used to a weak performance in industry in December, but nobody was prepared for this freefall. We need to revise our fourth quarter GDP forecast downward

| -3.7% |

Industrial production (YoY, calendar-adjusted)Consensus 3.3% / Previous 5.3% |

| Worse than expected | |

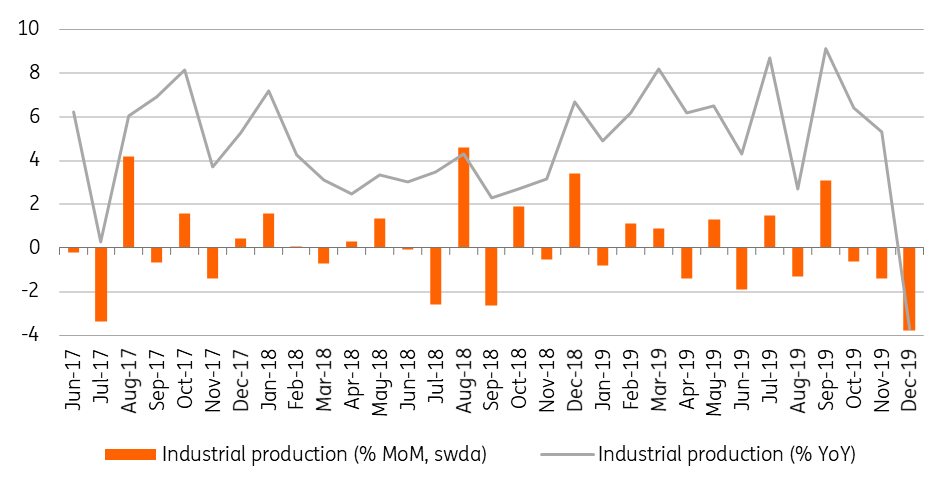

Hungary’s industry closed 2019 with a really bad performance, posting a 3.7% year-on-year drop in December, based on calendar-adjusted data. The last time we saw such a freefall in industrial production was back in November 2012. Today’s release also means that the volume of production in industry has now dropped for three consecutive months. In December, the data showed a 3.8% month-on-month decrease. Hungary's industrial sector hasn't been through such a bad period since 2015.

Performance of Hungarian industry

The commentary released by the Statistical Office makes clear that car manufacturing is behind the worse-than-expected performance, as production in the automotive industry “fell significantly”. Output growth of electronic products slowed, too. The improving performance of the food industry wasn’t enough to counterbalance the negative effects of the two biggest subsectors.

Manufacturing PMI and industrial production trends

The awful December performance again highlights that soft indicators, like the PMI readings, have become less useful guides. The manufacturing PMI suggested a strong performance, with a reading of 53.9 (the highest in six months). The Business Confidence Index has proved to be a better indicator, as it dropped markedly in December (although this showed a sound improvement in November when industry also surprised on the downside).

Production level and quarterly performance of industry

Having seen the full fourth quarter data for industry, we need to tame our optimistic GDP growth expectations. Industry output fell on a quarterly basis and posted the worst year-on-year performance since the fourth quarter of 2016. Such a weak performance should cut into economic growth, nullifying the retail sector’s encouraging fourth quarter result. We now expect to see GDP growth coming in around 4%, rather than our recent forecast of 4.5% in 4Q19.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap