Industrial production in Hungary back to 2015 levels

Another rebound in monthly Hungarian industrial production is a huge positive surprise. Output has reached levels last seen in 2015. But any optimism will fade in the summer and it's unclear when Hungary will reach pre-crisis levels

| -12.2% |

Industrial production (YoY)Consensus -12.8% / Previous -27.8% |

| Higher than expected | |

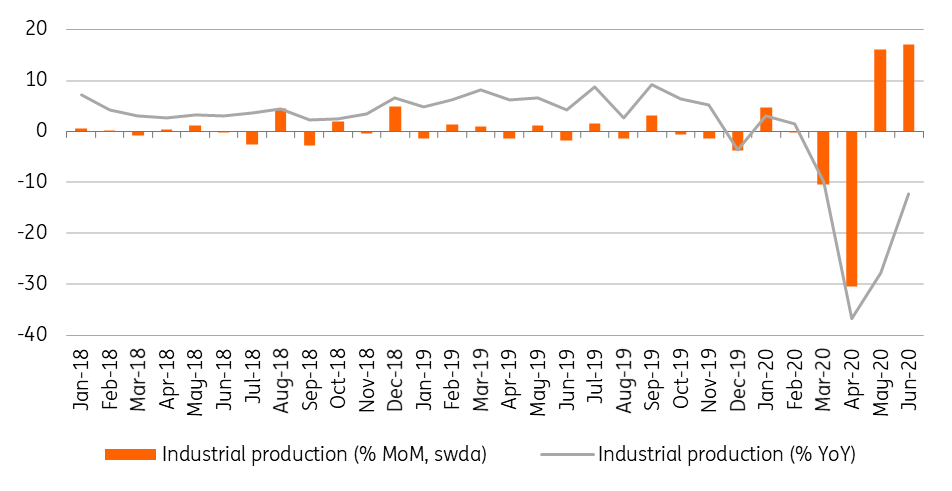

Hungary's industrial production surprised to the upside again in June. The 17.1% month-on-month marks a new record in monthly production growth following the 16% MoM we say in May. On a yearly basis, industrial production is still down by 12.2%, barely reaching the levels we saw in 2015. It's clear that industry is recovering from the Covid-19 shock but it's still unclear when it will be able to reach pre-crisis levels.

Hungarian industry performance

The easing of restrictions has not translated into any sort of normalisation. According to the Hungarian Central Statistical Office's report, the economic effects caused by the coronavirus were still being felt in this period. Car manufacturing continued to weaken in June, while production levels in other major sectors (electronics, food) have already been able to rise slightly. Based on this, we can say that as long as the automotive industry does not see any recovery, industry as a whole will lag far behind.

Manufacturing PMI and industrial production trends

A weaker summer

It’s not necessarily reflected in the latest manufacturing PMI figures, but after the favourable data in May and June, weaker performance can be expected in the summer months. This is because car manufacturers are sticking to their usual summer shutdowns with Mercedes-Benz closing at the end of July and Audi and Suzuki later this month. So the recovery will come to a halt in the coming weeks.

The level of production: industry & retail sector

Moving forward to the bigger picture, in terms of GDP developments, industrial performance was extremely weak throughout the second quarter of 2020. In both annual and quarterly basis, production volumes deep dived by nearly a quarter, an all-time negative record. All this may have been a significant drag on GDP growth. According to our estimation, industry will shave off 4-5ppt from the GDP growth. Looking at retail and industry data together, we continue to believe that gross domestic product may have fallen roughly 10.5% year-on-year in 2Q20.

Industry's output, value added and GDP contribution

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap