Hungary: Current account deficit widens

The Hungarian current account balance caused an upside surprise in 2Q20, but still shows the widest deficit since end-2008. We see improvement ahead

According to the latest data release of the National Bank of Hungary, the current account balance has once again turned negative in 2Q20 after a relatively strong first quarter. The last time the current account posted such a high deficit was in the period of the global financial crisis in 2008. With this quarterly performance, the stabilisation / slight improvement in the current account balance in the past quarters has come to a sudden end. According to the four-quarter rolling data, the current account balance has fallen to -1.1% of GDP.

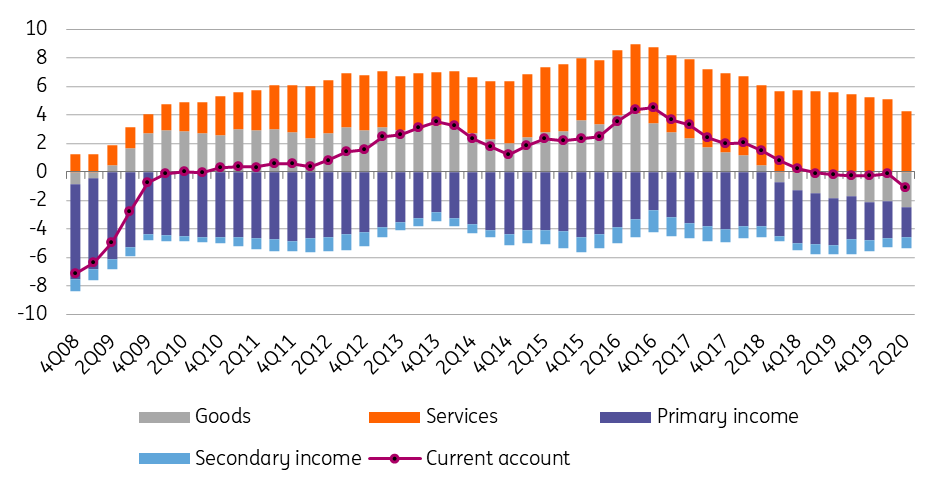

Current account breakdown (% of GDP, four-quarter rolling)

It’s easy to find a reason behind this strong swing: coronavirus. With the Covid-19 causing significant shocks all across the trade channels, it hardly comes as a surprise that every aspect of the current account saw a deterioration. With supply chain and related export issues, the balance in goods remained in deficit. The previously strong supporter of the external balance, services took a hit via the zeroing tourism and transaction services. Both primary and secondary income improved slightly but did not prove to be a game changer compared to the developments in goods and services.

Looking forward, we expect the current account balance to improve somewhat in the second half of the year mainly on goods and incomes. On the other hand, the Covid-related travel restrictions will remain a significant drag on services. Against this backdrop, the 2020 current account balance could end up at -1.3% of GDP. As we see an economic rebound in 2021 with a vaccine to be ready to use, services (transport & tourism) can improve significantly supported by the strengthening in exports of goods again. The latter will be supported by the gradual increase in capacity utilisation of manufacturers with a rebound in global external demand.

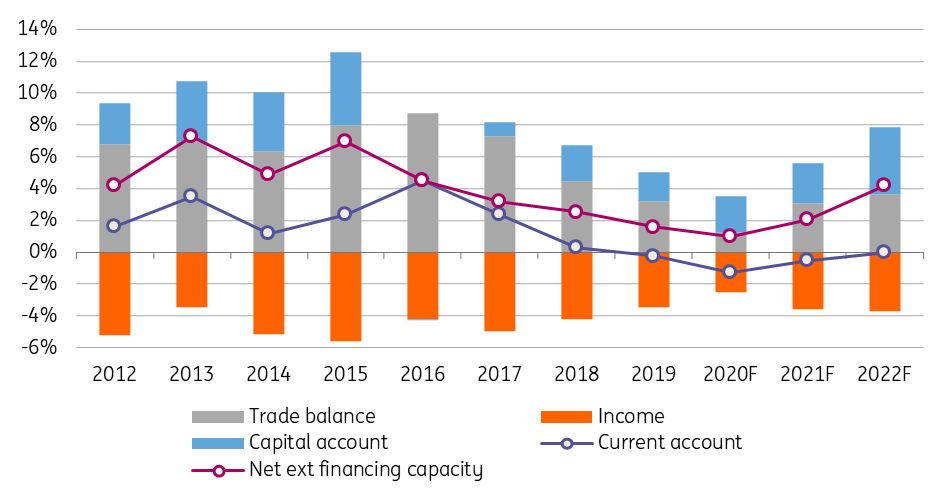

ING forecast - External balances (% of GDP)

Further improvement is expected in 2022, when we see the current account reaching zero again. This will be supported by services, while the balance of goods will deteriorate again on the expected investment boom. The import share of investments in Hungary is high, so with new (mainly EU co-funded) projects set to start in the second half of 2021, the majority of the current account-related hit will spill over into the curent account balance in 2022.

From an external vulnerability point of view, it is more important, that the net external financing capacity of Hungary will increase again from 1% of GDP in 2020 to 4.2% of GDP in 2022, mainly due to the incoming EU transfers related to the new 2021-2027 Multi-annual Financial Framework and to the Recovery Fund.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap