Hungary’s CPI inflation rate at its highest since 2012

The headline inflation rate in Hungary is at its highest rate in nearly seven years, but at least it's rising at a slower pace. It may well start turning more to target soon although there are still plenty of external and domestic pressures

| 3.9% |

Hungarian CPI (YoY)Previous (3.7%) |

| As expected | |

After two months of intense acceleration, Hungary's headline inflation increased but its pace is slowing. It rose to 3.9% YoY in April from 3.7% YoY in March, so it's really close to the upper end of the Hungarian central bank’s tolerance band. This is the highest reading since December 2012. The main drivers are again food products, tobacco and alcoholic drinks as well as services and fuel, while food inflation slowed a little. Services inflation remained unchanged at 3% YoY, which is interesting given strong wage growth and anecdotal evidence. Inflation in durables also weakened somewhat.

The composition of headline inflation (ppt)

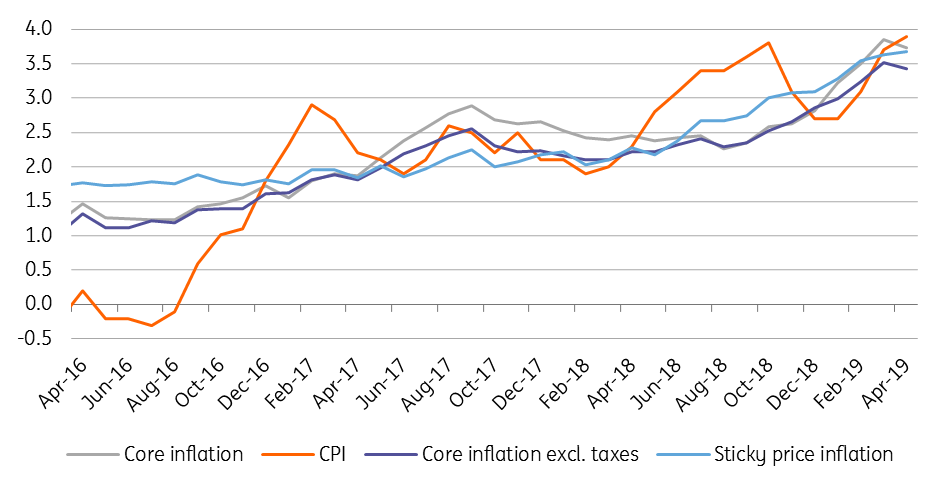

Against this backdrop, it's not surprising that underlying inflation – after a long trend of acceleration – showed a marginal decrease. Core CPI retreated by 0.1ppt to 3.7% YoY in April. The most important reading for the National Bank of Hungary is core inflation excluding indirect taxes, which also posted a slight decrease along with the core reading, and now stands at 3.4% YoY. The indirect tax effect remains at 0.3ppt just as in March.

Headline and core inflation measures (% YoY)

When it comes to monetary policy, it seems the NBH dodged a bullet, as none of the inflation readings reached 4%. However, there are still many external and domestic risks that could see inflation push still higher in the future. The domestic economic outlook is positive, and high wage growth prevails against all expectations, so that all may start to materially appear more in services' inflation.

Don't forget that if the Eurozone recovers sooner than the NBH expects - watch out for Germany causing an upside surprise with its 1Q19 GDP growth - the cooling effect over the monetary policy horizon might be weaker. In this case, even higher inflation and weaker HUF are probable. However, our forecast for inflation, for the time being, remains unchanged at 3.3% YoY on average in 2019. Therefore, we expect that the ‘data-driven’ NBH won’t take any significant tightening step to fight against inflation in the short run, at least not until the June inflation report.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap