Hungary: Core inflation on the rise

Hungary's headline inflation dropped to 2.7% on a yearly basis but core inflation excluding indirect taxes, a key indicator for the monetary policy, reached its highest level since 2012

| 2.7% |

Headline inflation (YoY)Consensus (2.7%) / Previous (3.1%) |

| As expected | |

Hungary's headline inflation came in at 2.7% YoY in December, a 0.4ppt drop compared to the November reading. We do not see this drop as a surprise as lower oil and fuel prices will have had a significant effect on the headline reading. According to the Hungarian Central Statistical Office, fuel prices lowered by 6.9% in a month, showing only a 1% rise on a yearly basis. The December year-on-year reading shows a significant deceleration from the 7.2% YoY rise in November. This implies that the drop in fuel prices dragged down the headline reading by 0.47ppt. This figure points to another important fact; underlying inflation is increasing steadily as despite the almost 0.5ppt effect from fuel prices, the headline figure came down ‘only’ 0.4ppt.

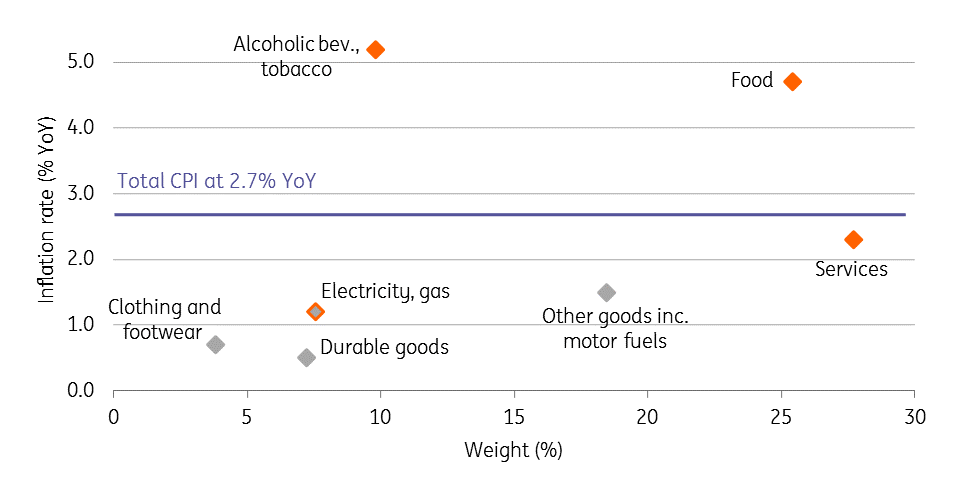

CPI by main groups in December 2018

In the details, we see inflation in food and tobacco accelerating at an above-average level, but more importantly, inflation in services also strengthening. Regarding the latter, the 2.3% YoY price increase in December posts a rise not seen since early 2015. Against this backdrop, the further acceleration in core inflation hardly comes as a surprise. The 2.8% YoY reading is the highest since September 2017 and the second highest since early 2014. The NBH-calculated core CPI excluding indirect taxes is also up by 0.2ppt to 2.9% YoY, the highest figure in seven years. This is the most crucial indicator, as the central bank sees this reading as a lynchpin for upcoming monetary policy decisions.

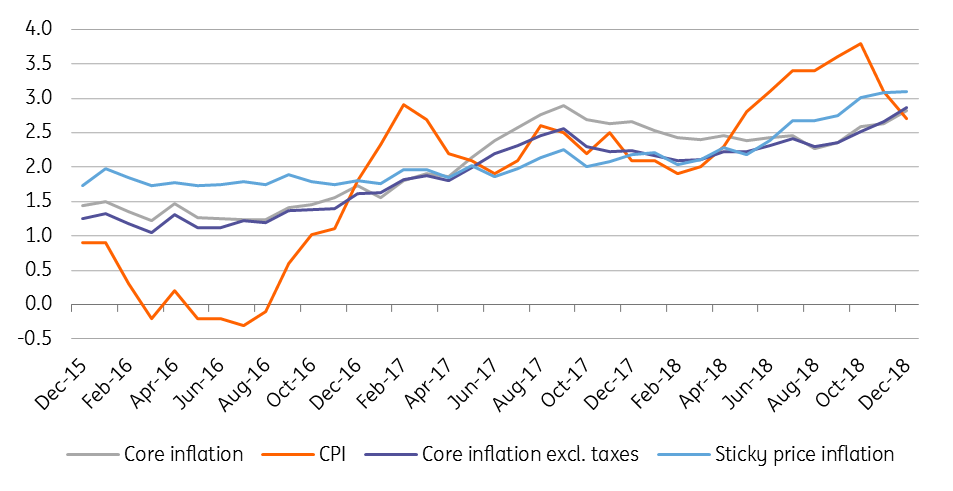

Headline and core inflation measures (% YoY)

We see underlying inflation strengthening further over the coming months. January could bring a significant wave of re-pricing by companies; labour is becoming more expensive, prices of capital goods are on the rise, input prices are increasing and the HUF is weak. If we put all of these elements together it is hard to imagine companies not raising their prices as the new year gets underway. Against this backdrop, we see core CPI increasing further, to reach an above 3% level in January and we believe it will remain there for the remainder of the year. This should push the NBH to start its monetary policy (first of all Bubor) normalisation in 2019.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap