Hungary: Core inflation accelerates further

The August set of inflation data was a mixed bag. While the acceleration in headline inflation eased, this was due to non-core elements. Core inflation accelerated further on second-round effects and supply constraints

| 3.9% |

Headline inflation (YoY)Consensus 3.9% / Previous 3.8% |

| As expected | |

Headline inflation came in at 3.9% year-on-year in August, showing only a modest 0.1 percentage point acceleration over the July reading. So, the pace of growth in prices has finally eased with an unchanged average price level on a monthly basis. This slowdown was mainly driven by non-core elements.

Main drivers of the headline CPI change (%)

The breakdown

- Fuel prices dropped by almost 1% on a monthly basis, in line with the global oil price move. With this change, fuel is 4.7% cheaper than a year ago;

- Inflation in food accelerated from 7.8% to 7.9% YoY in August, but the aggregate figure doesn’t tell the whole story. Prices of meat, seasonal fruit, vegetables and potatoes dropped on a monthly basis, and eased from a year ago as well. So, unprocessed food kept inflation in check. However, the previous months’ significant increase in raw food showed up in processed food prices as a second-round effect. For example, processed meat, dairy products, oils and sweets all show elevated prices;

- The government increased the excise duty on tobacco products in July, but due to methodological reasons, part of that spilled over into the August data. Tobacco is now 10.3% more expensive than a year ago.

- It hardly comes as a surprise that after the Covid-shock, the reopening of the economy caused a run in services, causing a significant mismatch between supply and demand. The 3.5% YoY inflation was mainly driven by higher prices in cultural, educational, entertainment and recreational services. Service providers were trying to cover some of their losses in a short time frame.

The composition of headline inflation (ppt)

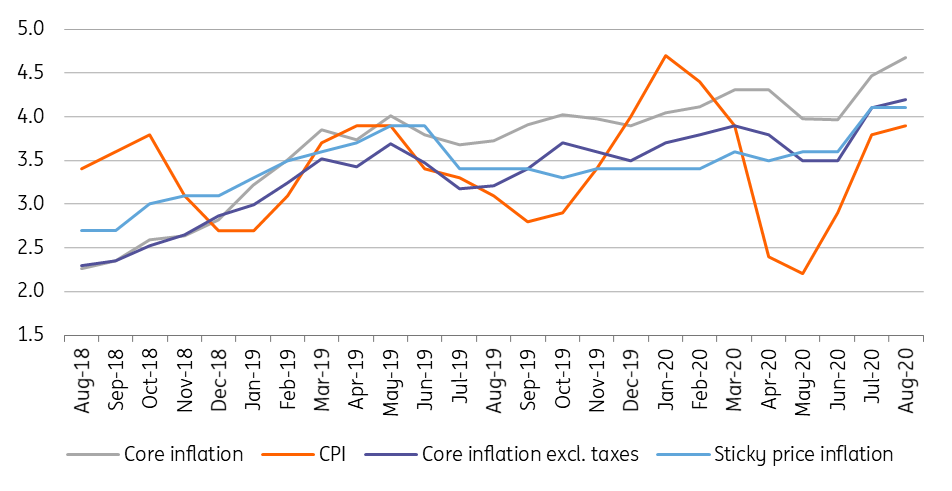

Against this backdrop, we can see that it was mainly non-core factors which were responsible for month-on-month inflation easing, while core elements showed increased price pressure. In line with that, core inflation led to an upside surprise, accelerating by 0.2ppt to 4.7% YoY. This is way above the National Bank of Hungary’s 2–4% target range. However, as part of that acceleration is coming from the excise duty hike, core inflation excluding indirect taxes was up by only 0.1ppt to 4.2% YoY. Nonetheless, this is also above the target range.

Headline and core inflation measures (% YoY)

What's next?

It's clear that there is an issue with inflation and the central bank must admit that. Today's data might trigger more hawkish communication by the NBH at its September meeting. However, a sudden rate hike would be too harsh, in our view, and might be not necessary either. In the coming months, we see inflation pressure easing due to base effects and lower fuel prices while a softening in the supply-demand mismatch would also help.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap