Hungary’s core and headline inflation readings are above 20%

Headline inflation made a big leap in September on household energy prices, but underlying price pressures increased as well. However, we see some signs supporting our view that the peak might be close

| 20.1% |

Inflation (YoY)ING forecast 19.9% / Previous 15.6% |

| Higher than expected | |

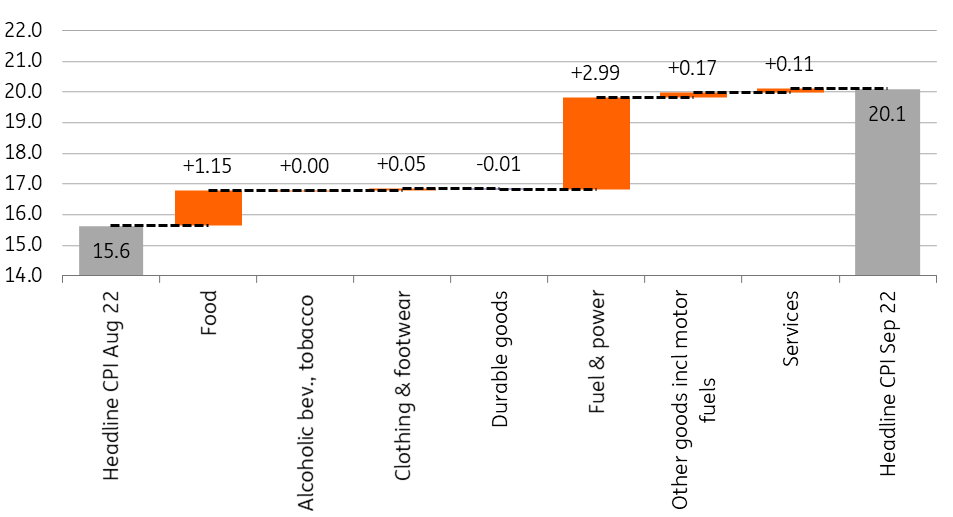

The anatomy of a one-off extreme inflation acceleration

There was widespread agreement among analysts that September's headline inflation figure would see an extreme jump. And they were not wrong. Inflation rose by 4.1% on a monthly basis, translating into a 20.1% year-on-year inflation print. The last time the monthly price increase came in above 4% was in January 1996. The main drivers behind the eyebrow-raising 4.5ppt acceleration from August to September came as no surprise.

Main drivers of the change in headline CPI (%)

The details

- Due to the changes in regulation in household utility prices effective from 1 August, the price of electricity, gas and other fuel went up by 62.1% year-on-year. In contrast with the HICP (Eurostat) data, the domestic consumer price index invoice - namely the payment due date counts, which are characteristically for energy services, arrive the month following the consumption. The jump in household energy prices was responsible for 3ppt of the total 4.5ppt acceleration in headline inflation. Household energy prices are subject to change on a quarterly basis and the next price decision comes in December. With the recent drop in gas and electricity prices, we see only a moderate chance for further price increases in utility prices.

- Price changes in food have remained a key contributor to the monthly price increase. Prices rose by roughly 35% on a yearly basis in this product group, with both processed and unprocessed food showing a significant increase. According to the central bank’s estimate, 75% of the rise in food prices is coming from processed foods. Supply chain issues in agriculture, drought, labour shortage and higher energy bills are all contributing to rising food prices.

- Fast-moving consumer goods are also getting more expensive as inflation accelerated in household goods and goods for recreation. Inflation in services has remained subdued compared to the headline inflation, although we saw further acceleration to 8.2% YoY. This was fuelled by cultural and educational services as well as by household services. Prices of recreational services dropped by 13.6% compared to August in line with seasonality.

The composition of headline inflation (ppt)

A 26-year record has been broken with 20% readings

As the most significant upward effect in inflation came from energy prices, it hardly comes as a surprise that the acceleration in core inflation was more moderate than the move in the headline reading. Nonetheless, core inflation moved to 20.7% year-on-year, somewhat below market expectations. This is the first time since September 1996 that both core and headline inflation have moved above 20%. Besides core inflation, the underlying price pressures can also be perceived from the share of items showing above-average inflation. According to our estimate, 44% of the items in the consumer basket have already shown at least a 20% YoY inflation figure in September.

Headline and underlying inflation measures (% YoY)

Some signs point to an upcoming ease in price pressure

Inflation in Hungary is expected to strengthen further in the coming months. However, we expect the pace of acceleration to slow down significantly. In practice, we see much lower month-on-month inflation prints going forward, which means we will possibly see the peak in inflation within six months. We see the peak around 21% early next year, as we expect the government to keep the price caps in place, extending them before they expire by the end of the year.

Despite all the supply-side shocks, there are some signs that point to a cooling of inflation pressure. The volume of turnover in retail sales has been on a decline for five months (excluding fuel retailing), suggesting a significant reduction in consumption. Households have already started to adjust their demand lower, reacting to higher prices. In line with that, expectations for retail sales prices declined sharply according to the Eurostat survey. On top of that, business price expectations for services fell slightly as well in September.

Changes in the expectations for retail sales prices and core inflation

Somewhat surprisingly, weak forint didn’t spill over into consumer prices of durables. Monthly inflation of industrial goods has been decelerating for three months now and according to the NBH’s data, it is now only 0.8% month-on-month. This is the lowest figure since January 2022. Last but not least, as we pointed out, the two most important contributors behind the acceleration were food and energy. The monthly change in core inflation excluding processed food has been also on a slowing trend since July.

Our point here is, that despite the above 20% inflation readings in September, we have seen some signs of changes in some part of the consumer basket. These can provide some restrained optimism that underlying inflation might reach a turning point soon.

Our inflation forecast remains broadly unchanged

After today’s headline reading, we forecast a 14% average inflation 2022, with a roughly 15% inflation in 2023. The first reason behind the acceleration, that the carry-over effect will give a massive boost to next year’s reading. Secondly, even with the expected ease in underlying price pressure as a result of the recession, the deceleration will be slow during the first half of 2023. We see inflation dropping to 3% only in the second half of 2024.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap